Understanding free cash flow can make you a master of cash flow management. Each part of the formula tells a story of how your company creates or uses cash. Deciding the best use for cash flow requires a clear purpose and strategic plan for your company.

Your company produces operational cash that can:

-

- Be reinvested in the company via buildings and equipment

-

- Pay down debt

-

- Be distributed to owners

The free cash flow formula is an easy and useful way to find out how much cash is available for each of the three uses above. More importantly, you can model how much of your future cash you want to allocate to those three uses.

I’ll walk you through the components of the formula. This will show you where each source or use of cash is hidden in the formula and how to improve them. I’ll then show you how to adjust each part to turbo-charge your cash flow planning.

The Free Cash Flow Formula

The free cash flow formula is: Net Income + Non-Cash Expenses – Change in Current Operating Assets Excluding Cash + Change in Current Operating Liabilities Excluding Short-Term Debt – Capital Expenditures. In other words, it’s your operating cash flow minus capital expenditures. Another way to calculate it is to use your cash from operations from the statement of cash flows and deduct capital expenditures.

Capital expenditures are the big investments you make in buildings, furniture, and equipment. These purchases are often funded with cash and loans. The formula only deducts what you paid for in cash.

You could get operating cash flow amounts from a cash flow statement, cash flow projection, or use the above formula (excluding capital expenditures). The most common non-cash expenses that are added back to net income in the formula are depreciation and amortization.

Current assets are balance sheet items you’ll collect in cash within a year. The biggest items for many companies are accounts receivable and inventory. Current assets include cash, but cash is removed from current assets in the formula. We don’t want to include cash in the formula because the formula is calculating the change in cash.

Current liabilities are balance sheet items you’ll pay within a year. The biggest item for most companies is accounts payable. Short-term debt is excluded from current liabilities when calculating free cash flow.

Free cash flow is often thought of as cash flow before flows to/from debt and equity. Unlevered free cash flow is another version of free cash flow that also adds back the interest payments net of their tax effects.

Cash Trapped in Net Working Capital

Net working capital is your current assets less your current liabilities. Here’s the extremely important concept that many businesses don’t understand: net working capital can suck away cash. To understand how, check out my articles on the cash conversion cycle and permanent working capital.

A negative change in net working capital means some of the cash from your current earnings got trapped in working capital. A positive change in net working capital means you managed cash well and freed up some of that trapped cash.

Free Cash Flow vs. Total Cash Available

Free cash flow measures the cash that’s available to pay down debt and distribute to owners. It can be very volatile, depending on the size of capital expenditures. You may have built a cash reserve in previous years to fund a capital expenditure in the current year. Free cash flow only captures the current period’s cash flows. You need to add your cash balances and changes in cash from free cash flow to see all the cash available for lenders and owners.

Free Cash Flow to Equity

Free cash flow to equity measures the cash that’s available to the owners and investors in a company. This looks at cash after cash flows from debt.

The formula for Free Cash Flow to Equity is: Net Income + Non-Cash Expenses – Change in Current Operating Assets Excluding Cash + Change in Current Operating Liabilities Excluding Short-Term Debt – Capital Expenditures + Net New Debt.

In other words, it’s free cash flow plus the change in debt. Once again, this measure can be very volatile, depending on the size of capital expenditures.

Free cash flow to equity assumes that increases in debt create cash that’s available to owners. I don’t recommend taking out loans in order to immediately give that cash to owners.

Example of Free Cash Flow and Free Cash Flow to Equity

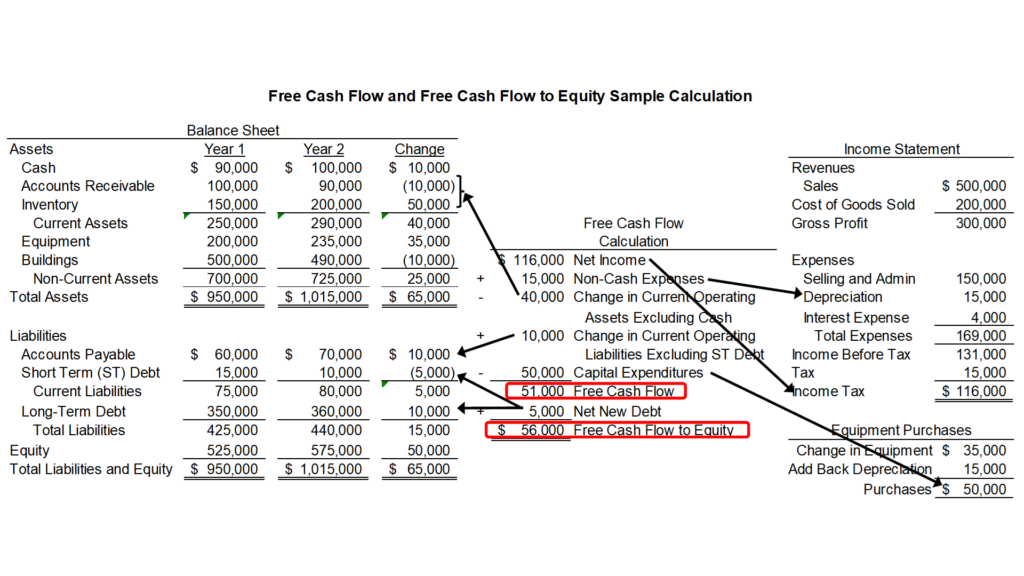

The example below shows how to calculate free cash flow and free cash flow to equity. You need a balance sheet and income statement. Once again, this shows that cash flows include more than profits; cash is also trapped or released in your balance sheet.

It starts with net income. The only non-cash expense for this simple example company is depreciation, which is added back to net income. Next is the change in current operating assets, excluding cash. For this company, the only two items are accounts receivable and inventory. The sum of their change is deducted from net income. An increase in operating assets (excluding cash) consumes cash.

Next, current operating liabilities less short-term (ST) debt are added to net income. I explained earlier why debt is excluded from this calculation.

In this example, I used the change in capital assets on the balance sheet and depreciation expense to calculate capital expenditures. It’s more likely you know your capital expenditures, so you don’t need to calculate them from the financial statements like I did. It’s intuitive that capital expenditures are deducted from net income because they are big cash outflows that aren’t in net income.

This brings you to Free Cash Flow. When you deduct net new debt from that, you get Free Cash Flow to Equity. In this example, you need to add the changes to both long-term and short-term debt to get the total change in debt.

The Corporate Financial Institute (CFI) has a great example of calculating different versions of free cash flow using a statement of cash flows. You can likely get statements of cash flow for the past, but you may not have them for projections.

Free Cash Flow and Value

A company that creates free cash is more valuable. This free cash can be distributed to owners, or they can get their cash from selling the company.

The more free cash flow you have, the more valuable your company. The more valuable the company, the higher the selling price of the company. The higher the selling price of the company, the more cash the investors get when they sell their ownership.

Putting all the Parts Together to Master Cash Flow

Now let’s look at the major ways you can create or use cash. They are captured in the calculation for Free Cash Flow to Equity. The formula is: Net Income + Non-Cash Expenses – Change in Current Operating Assets Excluding Cash + Change in Current Operating Liabilities Excluding Short-Term Debt – Capital Expenditures + Net New Debt. Two pieces need to be in place to create operational cash flow:

-

- Net Income: It all starts with a profitable business model. This is the foundation for creating cash. The first step is hitting your break-even point. Understanding how to model your costs and revenue helps you make decisions that lead to more profit. Ultimately, it all comes down to creating value.

-

- Change in Working Capital: Just because a company is earning profits doesn’t mean that it’s creating cash. Profit is not the same as cash flow. I talked earlier about how cash can get trapped in working capital. The biggest mistakes I’ve seen here are not collecting accounts receivable or paying invoices too early. I talk about how to improve working capital here.

If operating cash flow is negative and we are low on cash, we must get cash from lenders or owners. If operational cash flow is positive, we can now make significant planning decisions with this cash flow. Our four main options are:

-

- Working capital growth

-

- Capital investments

-

- Pay down debt

-

- Distribute to owners

Here’s more detail on each option:

Working Capital Growth

The first option is organic growth. Growth takes cash. This is hidden in the formula for operational cash flow. Growth in working capital is a use of cash. When we grow, our working capital grows. It becomes part of our permanent working capital.

Capital Investments

You may want to make a big leap forward in growth. This may take capital investments in new locations, equipment, or upgraded facilities. These investments are usually a mix of cash from operations and borrowed funds.

Pay Down Debt

Leverage, or the use of borrowed funds, magnifies earnings. If you have more debt than you need, it’s just a drag on earnings. Some owners prefer to operate with no debt, even if the debt would increase earnings. They like to pay off any existing debt as soon as they are able to.

Distribute to Owners

This tends to either be a priority for cash or the last use of cash. Some owners have personal needs for cash, so distributions may be a higher priority over investing in the company or paying down debt. Other owners want to reinvest cash into the company for growth and long-term earnings. The sustainable growth rate formula shows us that taking money out of the company limits its growth.

What’s the Best Use of Free Cash Flow for Your Company?

The choice of how to use cash comes down to the strategic plan of each company. It all starts with the owner’s purpose for the company. Some owners will want to receive all the cash they can. Others will prioritize growth and keep the cash in their company. Some owners want to pay down debt as fast as possible. Do you have excess capacity in your current operations? You may want to maximize working capital growth rather than capital investments.

Looking to improve your cash flow management? Check out my Managing Cash Flow course.

For more info, check out these topics pages: