The sustainable growth rate formula reveals the two big decisions that determine how fast your company can grow.

Business owners pursue growth out of entrepreneurial instinct. Growth can mean opportunity and profits. However, your financial risk increases when you chase too little or too much growth. What are the keys to growth? The answers lie hidden in the sustainable growth rate formula.

The sustainable growth rate formula tells you the maximum amount your sales can grow without needing more cash from debt or equity. It’s a simple way to quickly estimate your growth potential based on some cash flow assumptions.

I explain the formula below to show exactly how it does this. The fear of formulas may have some of you breaking out now in a cold sweat. Fear not – I’ve made this easy for you. If you want a spreadsheet that does this for you, you can get one in my FAST program.

Better yet, it looks at what your sustainable growth rate formula amounts are at varying profitability levels and earning retention rates.

For those allergic to math, you can jump directly to the formula insights and the growth decisions owners must make.

Making the Sustainable Growth Formula Easy for You

Before I can show the formula’s power, I have to first explain the basics of the formula. I’ll go through the formula so you can better understand what the calculator does for you.

What I really want you to focus on are the concepts behind the formula. I’ll keep circling back to these. They are the path to buried treasure in this formula.

The Sustainable Growth Rate Formula Definition

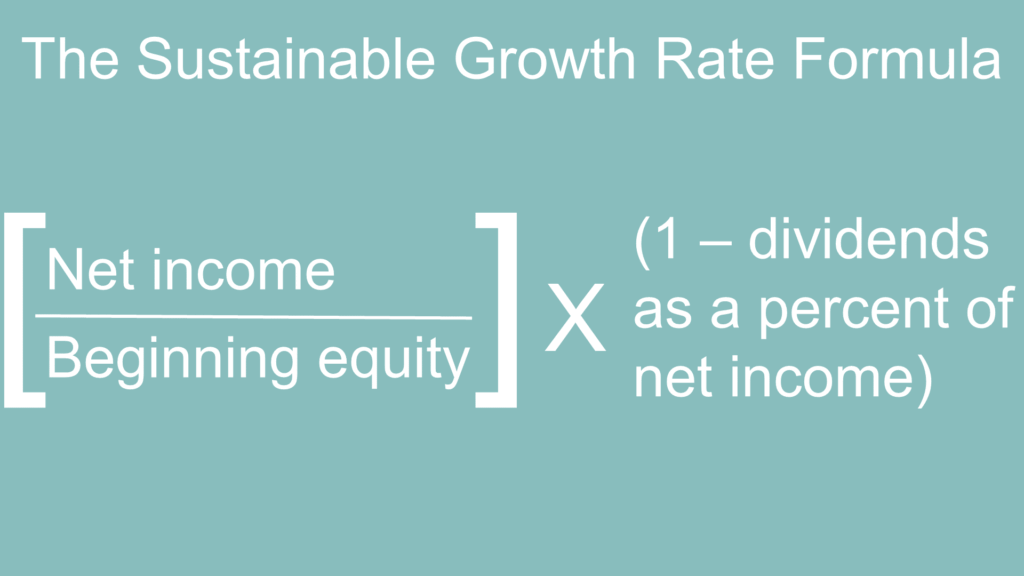

The sustainable growth rate formula is defined as: (net income/beginning equity) X (1-distributions to owners as a percent of net income)

The formula I just gave to you is good if you want to grab numbers from the balance sheet and income statement to calculate your sustainable growth rate.

Let me simplify the formula a little to start walking us through the concepts. The first half of the formula was your net income divided by your beginning equity. This is your return on equity (ROE).

The second half of the original formula was: (1 – your owner distributions as a percent of your income). This is called your earnings retention rate. Let’s dig into that a little more.

Sustainable Growth Rate Formula Example

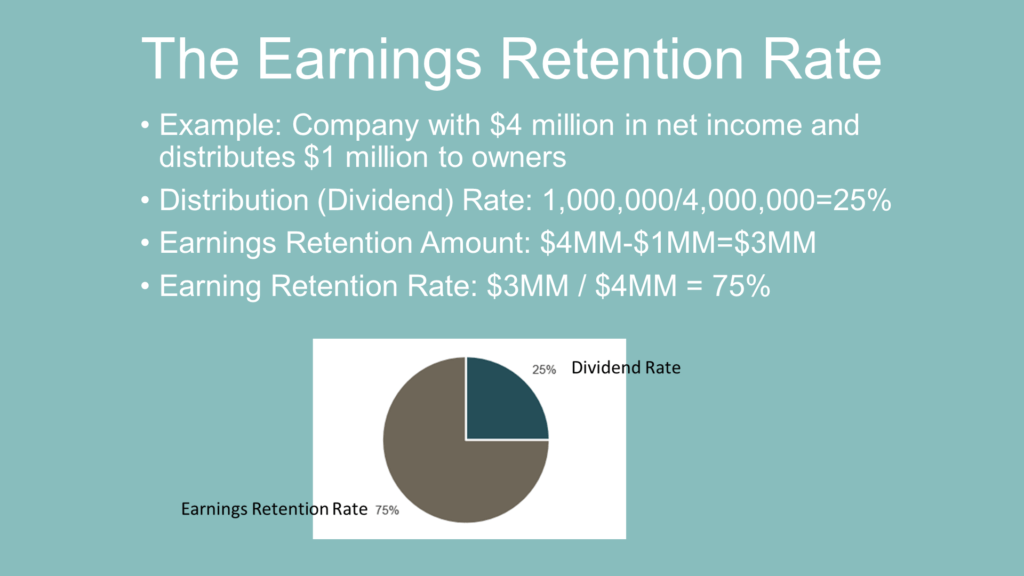

Let’s use an example company with $4 million of net income that distributes $1 million of that to the owners. Their distribution rate is the $1 million of distributions divided by $4 million of net income, which equals 25%.

If they had $4 million in earnings and distributed $1 million to owners, then that leaves $3 million of earnings that are retained in the company.

If you divide the $3 million earnings retention amount by the $4 million of earnings, then the earnings retention rate is 75%. Remember, the earnings retention rate is: 1 – the distribution rate. The 75% earnings retention rate is the same as 1 minus the 25% distribution rate.

Let’s explore this visually.

Think of your earnings as a pie where part of the pie gets distributed to owners and the rest stays with the company. In our example, 25% of the earnings were distributed so that left 75% of the earnings – and cash – in the company.

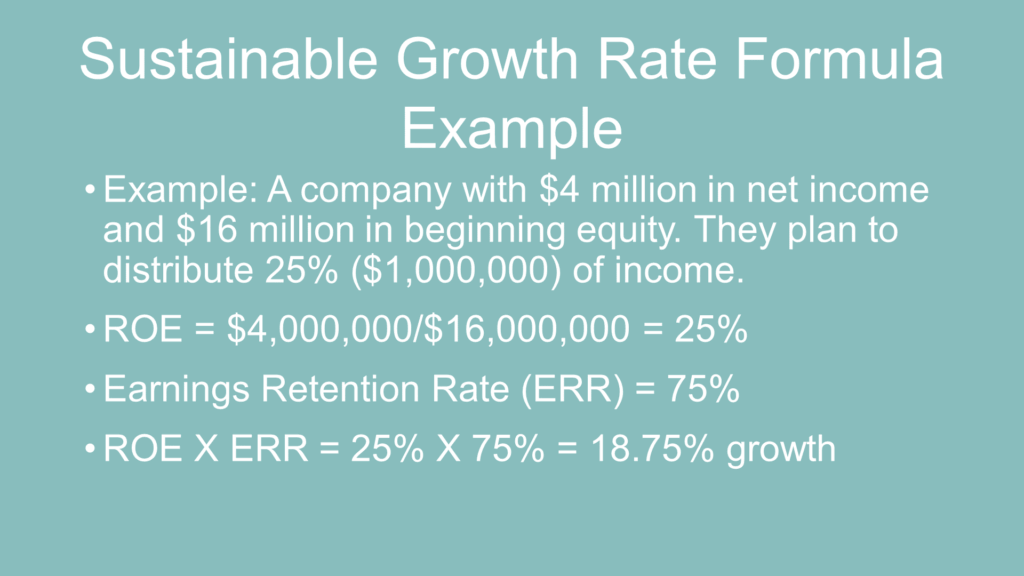

Let’s now calculate the sustainable growth rate formula for our sample company. As a recap, they have $4 million in income, we’ll assume they have $16 million in equity, and they plan to distribute $1 million, which is 25% of their income.

Their ROE is calculated as $4 million divided by $16 million, which is 25%. Their earnings retention rate is 75%, which we calculated in the previous slide.

The sustainable growth rate formula is ROE times the earnings retention rate. For them, that’s 25% times 75%, which equals 18.75% growth.

Sustainable Growth Rate Formula Calculation

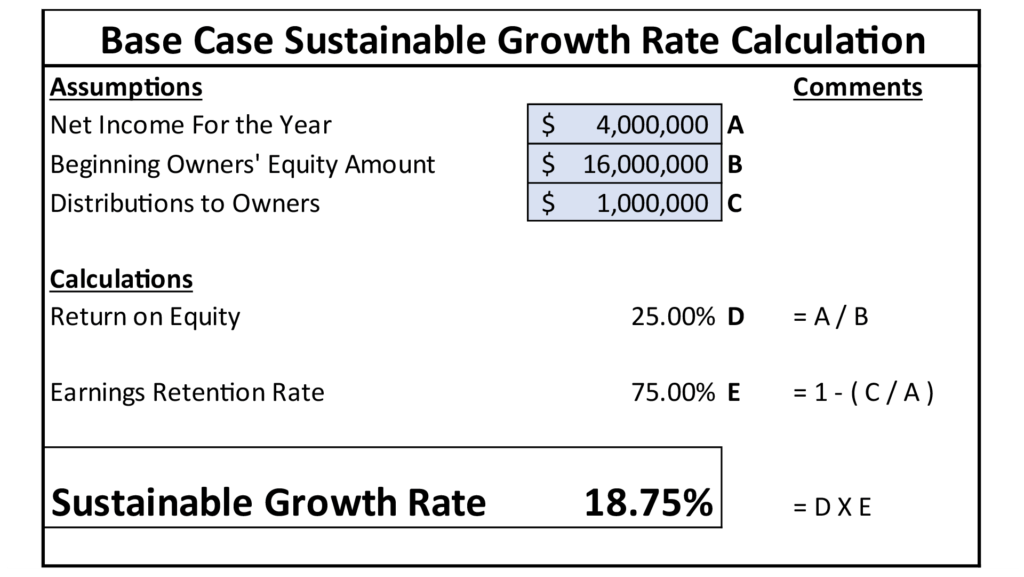

If your head is spinning from the math above, fear not. The image below will show how you can calculate it in Excel.

Here’s the sustainable growth rate formula from the calculator using the example company:

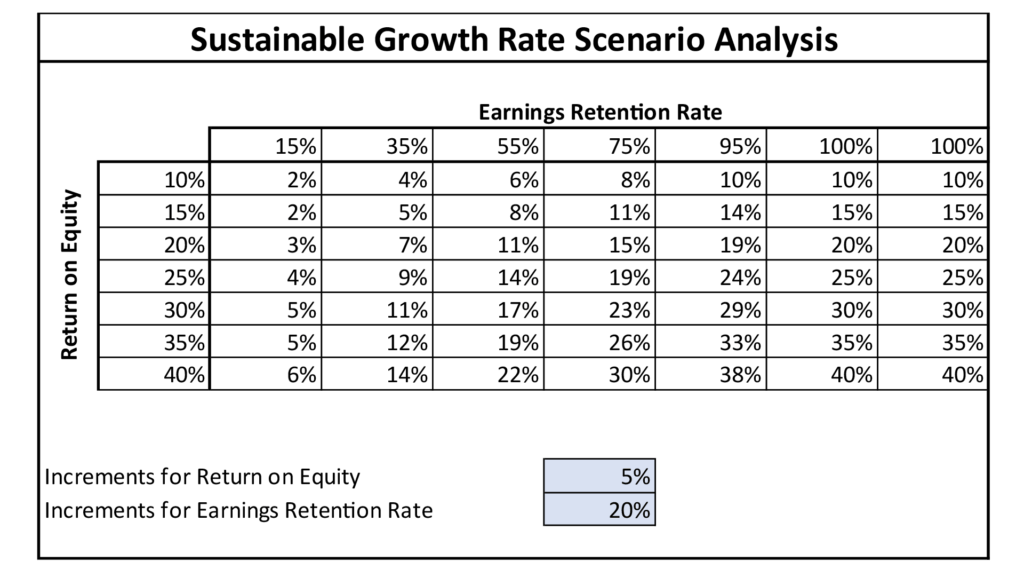

Now, what if you could increase your profitability (i.e., ROE)? What if you increased or decreased the earnings retention rate? Then how much could you grow according to the sustainable growth rate formula? The sustainable growth rate formula calculator in my FAST program shows you many options:

It shows a grid of potential growth rates at varying ROEs and earning retention rates.

Growth Insights in the Sustainable Growth Rate Formula

Let’s dive into the insights embedded in the formula. The formula shows what you need to do for sustainable growth. That’s powerful.

Once again, the simple formula for the sustainable sales growth rate is your Return on Equity (ROE) times the earnings retention rate. A paraphrase of that formula is: it’s what you earned times what you kept in the company. Now let’s dig into those two parts.

Your earnings and how much cash you keep in the company determine your sustainable growth rate.

What you earned is your return on equity. Your return on equity is your return on assets times your leverage. Leverage is the measure of how much debt you have. High leverage means financing your company with large amounts of debt.

Return on assets is your earnings divided by your assets. It measures your profitability. It’s about your profit margin but it also is about the cash conversion cycle and all the related turnover ratios.

The ROA-times-leverage formula above says you can magnify your return on equity (ROE) simply by increasing your leverage. However, increasing leverage (i.e., increasing debt) also increases your risk of bankruptcy in a cash crisis.

Another way to talk about ROA and ROE is that leverage magnifies ROE. A high ROA can be magnified into a high ROE. However, if you have a loss – if your ROA goes negative – then you have a massive negative ROE and may not have enough cash to survive.

The second half of the formula paraphrase tells us that the amount of cash you keep in the company greatly impacts your growth rate. You stunt your company’s growth when you pull money out of it.

The Two Big Growth Decisions for Business Owners

The three big numbers in the formula are your:

- ROA

- Leverage

- Earnings retention rate (i.e., the amount of earnings reinvested in the company)

Company owners rarely disagree that a higher ROA is better. The two big business strategy decisions you must make about growth are:

- How much leverage you’re comfortable with

- How much cash to distribute to owners

Company owners rarely disagree that a higher ROA is better. The two big business strategy decisions you must make about growth are:

- How much leverage you’re comfortable with

- How much cash to distribute to owners

The two big strategy decisions for sustainable growth are:

1. Leverage

2. Distributions

An owner with a high tolerance for risk will want more leverage than an owner who places a high value on the safety and sustainability of the company. These two owners will have to negotiate a compromise.

An owner who needs large cash distributions to fund their lifestyle will clash with an owner who wants to focus the company on growth.

Even a sole proprietor has to clarify their risk tolerances and personal financial needs to determine a sustainable growth rate for their company.

One way to increase your growth rate is to invest more cash into your company. Many owners don’t have the cash for this.

Of course, you always have another option to grow beyond the sustainable growth rate: get more cash from outside equity investors. But that involves selling off part of the company. It means you get a smaller share of future earnings and at least a partial loss of control. For some owners, that’s not a price they are willing to pay. For them, they are limited to the sustainable growth rate.

For more info, check out these topics pages: