Your business is a constant cycle of cash being invested and then received back, hopefully with a profit. This cycle is called the cash conversion cycle. Knowing how it works allows you to have less cash lost to the cycle. Most importantly, you’ll have cash available when you need it.

The cash conversion cycle of drawing in cash and releasing cash is like drawing in a breath and releasing it. A runner breathes more quickly the faster they go. Top athletes have trained their bodies to get the most power from that oxygen. Cash is the oxygen of your business. You’ll receive a higher return on your cash by speeding up your cash conversion cycle.

I’ll show you how the cycle works and why it causes cash to go down for a while when you reach for growth. Your cash conversion cycle may need to be supplemented with other cash sources that I’ll explain. Understanding the cash conversion cycle allows you to avoid cash crunches and capture opportunities.

The cash conversion cycle

Here’s how the cycle works:

- It starts with the cash you have in the bank. Cash in the bank is secure but it doesn’t earn you much income. You want to put it to work by selling goods or services.

- The next step of the cycle occurs when your employees spend time producing goods or providing services. They aren’t volunteers. At some point, you need to pay them for the work they did. If you are a manufacturer, you also order materials and spend money converting those raw materials into finished goods.

- At this point, you owe salaries to your staff and owe vendors for the materials you purchased but haven’t paid out any cash yet. Accrual accounting tracks what you owe to others and what’s owed to you at any point in time. Under accrual accounting, you would have accounts payable due to vendors and salaries payable to your employees.

- Your vendors and employees won’t wait forever for their cash. It’s time to pay them. This is a critical point in the cycle. You want to delay this as long as you can. Don’t get too cute and make your employees or vendors mad. Pay invoices when they are due but don’t pay before that date. We now turn to the part of the cycle where cash flows back to us.

- You can’t get your cash until someone owes it to you. They don’t owe you money until you provide some good or service to them. Making the sale and delivering the goods starts the clock ticking for you to finally receive your cash.

- The list of money due to you is called accounts receivable. In accrual accounting, you record revenue and an account receivable when you have completed the work and can collect payment. Collect cash on these receivables as early as possible.

And now we’re back to box #1. The virtuous cycle has ended. You get your money back along with your profit. And the cycle begins again…

Shorten the cash conversion cycle to improve your return on investment

Now you understand the basics of the cash conversion cycle. Let’s look into how you can maximize your return on investment by better managing the cycle.

The art of managing your cash conversion cycle is to delay the outflow of cash as long as possible while accelerating the inflow of cash. The cash conversion cycle is the length of time from when you pay cash to suppliers or employees until you receive cash on your sales.

The cash conversion cycle can be broken into three periods:

- Inventory to sale

- Sale to cash

- Purchase to payment

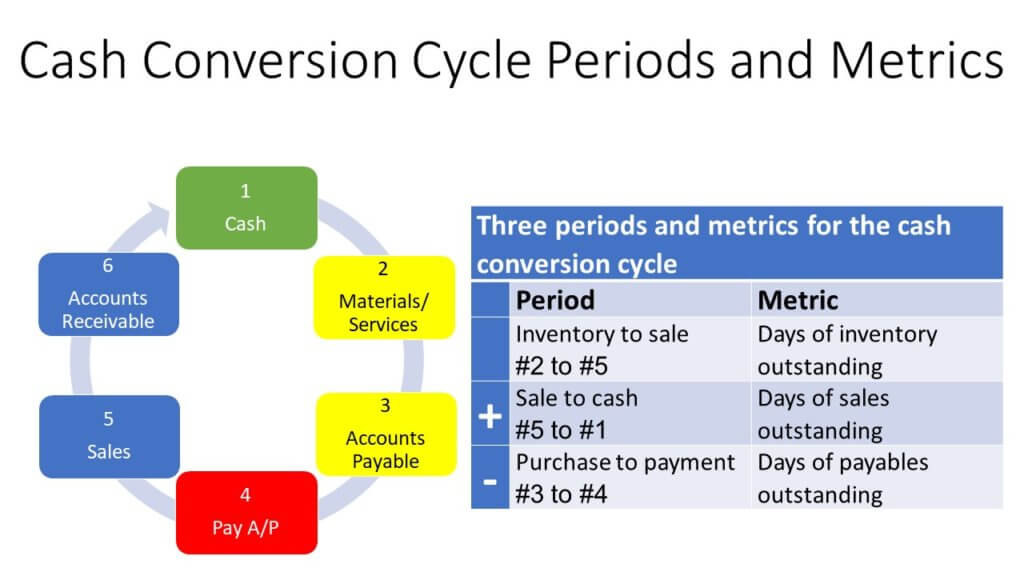

The graphic below shows the three periods and how they map to the cash flow cycle graphic presented earlier in this article. I’ll explain the metrics for each period later in this article.

Imagine a who distributor buys their inventory on January 1 and pays for it on January 15th. They take the product and put it in their warehouse, where it sits until they sell it on April 1st. They collect cash from the buyer 60 days later on May 31st.

Let’s break that down into the three periods:

| Period | Dates | Days |

| Inventory to sale | January 1 – April 1 | 91 |

| Sale to cash | April 1 – May 31 | 60 |

| Purchase to payment | January 1 – January 15 | -14 |

| Total cash collection cycle: | 137 |

They spent their cash on January 15th and didn’t get it back until May 31st. That’s 137 days. They lost that cash for over a third of the year!

The shorter the cash conversion cycle, the more cash you have to capture opportunities, make investments, or pay critical bills.

Some ways to shorten the cycle include:

- Send invoices as early as possible

- Provide incentives for quick payment

- Contact you past due customers and ask when they expect to pay you

- Factoring

- Not paying vendors until the due date.

- Negotiating payment plans with vendors

I go into more detail on these methods in my blog titled 12 Cash Flow Management Tips and One Essential Tool. These steps allow you to shorten the cycle so you can put your cash to work.

Have you ever been making sales but wondered where “where’s the cash?” It’s often sitting in your customers’ bank accounts. Ask for it!

Shortening the cycle

Let’s go back to our distributor and make some changes:

- They now don’t pay their vendor until the invoice is due on January 31st. That shortens their cash conversion cycle by 16 days.

- They buy smaller quantities of inventory but order more frequently. They may pay more in shipping or lose quantity discounts, but tying up cash in inventory also has costs. Storage facilities have costs. Ordering in smaller batches may also reduce spoilage and obsolescence of inventory. Our example distributor reduces their inventory, so it only sits in the warehouse for half the time. That reduces their cash conversion cycle by 45 days.

- They invoice immediately upon shipment and clearly state payment is due in 30 days. They call on customers who are late until those customers are trained to make timely payments. This decreases their cash conversion cycle by 30 days.

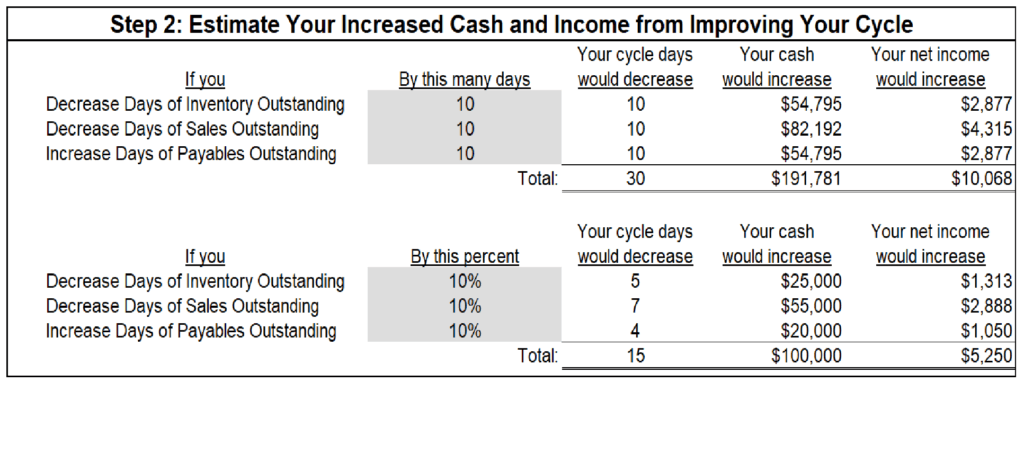

Putting this all together, we’ve reduced the cash conversion cycle by 91 days. It’s gone from 137 days to 46 days – a 66% decrease. Let’s say their account receivable used to average $1,000,000. Now it’s dropped to $330,000 and has released $660,000 of cash to be invested in the business. If they can earn a 10% return on business growth, they increased their profits by $66,000 per year.

Critical cash conversion cycle metrics

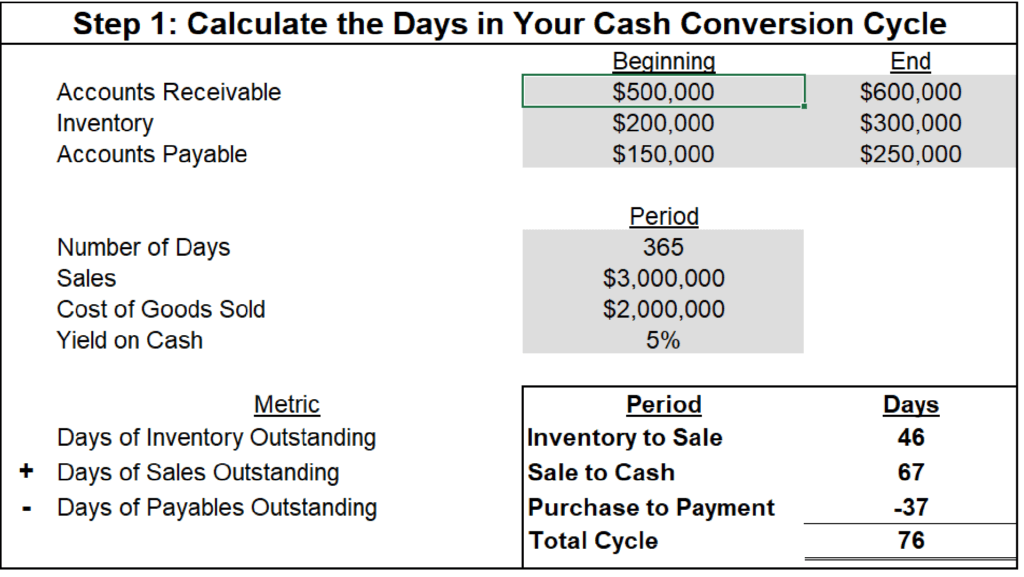

Now that you see how important the cash conversion cycle is to your cash flow, below is more detail on how to calculate your cycle. I also provide some key metrics that you can use to measure how well you’re managing the cash conversion cycle.

The most practical way to use these metrics is to calculate each metric for a recent period. Then, track them monthly to identify trends. See if the metrics are improving over time as you take the steps I described above to improve your cash flow.

Cash conversion cycle

The cash conversion cycle can be broken into three time periods with a metric to measure each period.

| Period | Metric | |

| Inventory to sale | Days of inventory outstanding | |

| + | Sale to cash | Days of sales outstanding |

| – | Purchase to payment | Days of payables outstanding |

Formula (periods): (Inventory-to-sale conversion period) + (sale-to-cash conversion period) – (purchase-to-payment conversion period)

Formula (metrics): (Days of inventory outstanding) + (days of sales outstanding) – (days of payables outstanding)

Is a higher or lower number better? Lower numbers are better

Explanation: The cash conversion cycle is the total number of days from when you pay cash until you receive cash from sales. You can monitor the full cycle time or each of the three periods individually to isolate exactly where your cash conversion cycle is speeding up or slowing down. I’ll now define and explain the metric formulas for each of the three periods.

Days of inventory outstanding (DIO)

Formula: Average inventories / (cost of goods sold/365)

Is a higher or lower number better? Lower numbers are better

Explanation: This is the average number of days it takes to sell inventory. The last part of the formula (i.e., cost of goods sold/365) is your average daily cost of goods. Divide your current or average inventory by that daily cost to calculate the number of days it takes you to sell inventory. Average inventories is calculated as starting inventory plus ending inventory divided by 2.

Days sales outstanding (DSO)

Formula: Average receivables / (net sales/365)

Is a higher or lower number better? Lower numbers are better

Explanation: This is the number of days it takes to collect cash from sales. The last part of the formula (i.e., net sales/365) is your average daily sales amount. Divide your current or average accounts receivable balance by your daily sales to calculate the number of days it takes to collect cash from sales.

Days payables outstanding (DPO)

Formula: (Average payables + average accrued liabilities) / (cost of goods sold/365)

Is a higher or lower number better? Higher numbers are better

Explanation: This is the number of days from the purchase of materials or labor until you pay cash for them. The last part of the formula (i.e., cost of goods sold/365) is the average daily cost of goods. Divide your current or payables and accrued liabilities (e.g., salaries payable) by that daily cost to calculate how many days on average you take to pay an invoice. You don’t want this metric to be so high that you anger your vendors and employees.

Cash flow vs revenue

The sales to cash period measured by the days sales outstanding metric shows the difference in cash flow vs revenue. These two are often confused. It’s true that cash-basis companies revenue when they receive the cash flow. This is a simplification for tracking that lets you record the revenue and the cash flow at the same time, but they are actually two different things.

Accrual based companies record revenue on the date it’s earned and cash on the date it’s received. Revenue is the income you earned by providing goods or services. Accounts receivable is cash that’s due to you because of the revenue you earned but has not yet been paid. The day you earned this revenue and when you actually receive that cash flow could be days, weeks, or months apart. Sadly, you sometimes never collect the cash.

I wanted to make this quick explanation of cash flow vs revenue because they are so often confused, just like profitability and cash flow. I go into much more detail about profitability vs. cash flow in this article.

The cash conversion cycle and growth

The cash conversion cycle also shows us how companies that try to grow quickly often find themselves in a cash crunch. In the cash conversion cycle, money goes out for a while before it comes back.

Many owners try to grow their way out of a sales slump. To do this, they often must buy more inventory and increase payroll costs. This increases their costs and further reduces their cash for the length of the cash conversion cycle. Cash will start to increase once they finally start collecting on the increased sales.

Higher sales levels also create a permanent increase in your working capital. Working capital is the difference between current assets and current liabilities. Specifically, growth causes accounts receivable (a current asset) and accounts payable (a current liability) to go up.

The increase in working capital is a long-term investment in your company. This investment should be funded with equity from the owners or long-term borrowing.

Growth creates a permanent increase in your working capital that requires long-term funding

Many owners use short-term loans like lines of credit or credit cards to fund the increase in working capital. Those loans need to be paid back long before the company earns much income on the permanent increase in working capital. This causes a cash crunch.

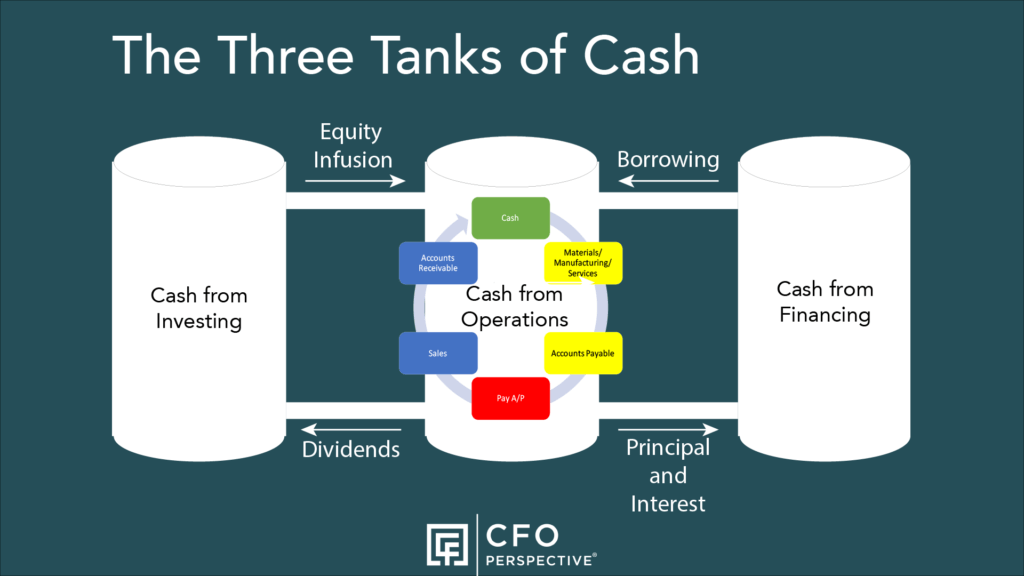

The cash conversion cycle explains operating cash inflows and outflows. As we saw in the growth scenario, you need investment and financing cash flows to support and balance your operating cash flows. Let’s look at how all three types of cash flows fit together.

Your three main sources and uses of cash

Think of managing your company’s cash as coordinating three tanks of liquid. In fact, a company’s access to cash is often referred to as its “liquidity”. Here’s a graphic of how the tanks work together.

There are three main sources and uses of cash. Think of each as a tank of cash:

- Investments: The investing tank is the amount of money your current and potential owners have available to invest in the company.

- Operations: The operations tank is your business’s checking account. The amount of cash in the tank rises and falls with the cash conversion cycle.

- Financing: The financing tank is the money you can borrow from banks, friends, and family.

A business starts when the owners transfer their liquid cash to the operations tank. The business spends this cash for operations, reducing the tank.

Soon the business produces a return on the cash, which starts to fill the tank back up. Successful businesses have so much cash coming into the tank that they can flow it back to the owners or make bigger investments for growth.

Once lenders are confident that you can keep your operations tank filled, they are willing to allow you to tap into their tank of funds when you need it. Now, the owners’ tank isn’t the only spare tank of cash available when you need cash for growth or a big investment.

How cash crunches happen

A cash crunch happens when the operations tank is draining and the owners have already drained everything they had in their investment tank. Lenders get concerned they won’t get their money back from the company, so they shut off their pipeline of cash to the company. I was a bank CFO during the Great Recession and saw companies get into this cash crunch situation.

A cash crunch happens when the operations tank is draining and the owners have already drained everything they had in their investment tank.

Ironically, what often caused the cash crunches were good economic times. Owners saw lots of opportunities to make profits in their companies. They drained all their personal cash reserves into the company. At the same time, they borrowed all they could and made big investments.

Everything worked as long as the economy allowed the operations tank to quickly refill with cash. However, the economy repeatedly goes up and then goes down. When it goes down, the operations tank fills much more slowly. With no reserves in the investment tank and no more access to the borrowing tank, the operations tank went down the expense drain.

A thinking error called the extrapolation bias causes us to think the future will be like the present and the past. Our natural optimism as business owners continues to see opportunities. Always keep some reserve in the investment and financing tanks. You may need it for business downturns or unexpected opportunities.

Going with the flow

This post showed how to maintain and increase the precious flow of cash in your company. You can create a permanent increase in your operations tanks by shortening the cash conversion cycle.

Growth can cause a long-term decrease in the tank. Keeping cash reserves in all tanks is extremely important. Get my full set of cash flow management tools and tips with my Managing Cash Flow Program. This course will help you avoid common cash management mistakes, reduce stressful periods of low cash, and get the cash you need for growth.

For more info, check out these topics pages: