Many Small Business Owners Don’t Appreciate the Differences Between Cash Flow and Profit. Those Who Understand the Difference of Profit vs Cash Flow Get Both.

There is a saying that “the person who chases two rabbits captures neither.” In the short term, you often have to focus on cash flow or profit. With the right strategy, you can capture both in the long term.

Would you rather have $100,000 of profit or $100,000 of cash flow? They’re vastly different. Cash flow and profitability measure two different things.

Cash is the gas in your company’s engine that keeps your business running. When the tank’s empty, you stall. Michael Dell once lamented, “We were always focused on our profit and loss statement. But cash flow was not a regularly discussed topic. It was as if we were driving along, watching only the speedometer, when in fact we were running out of gas.”

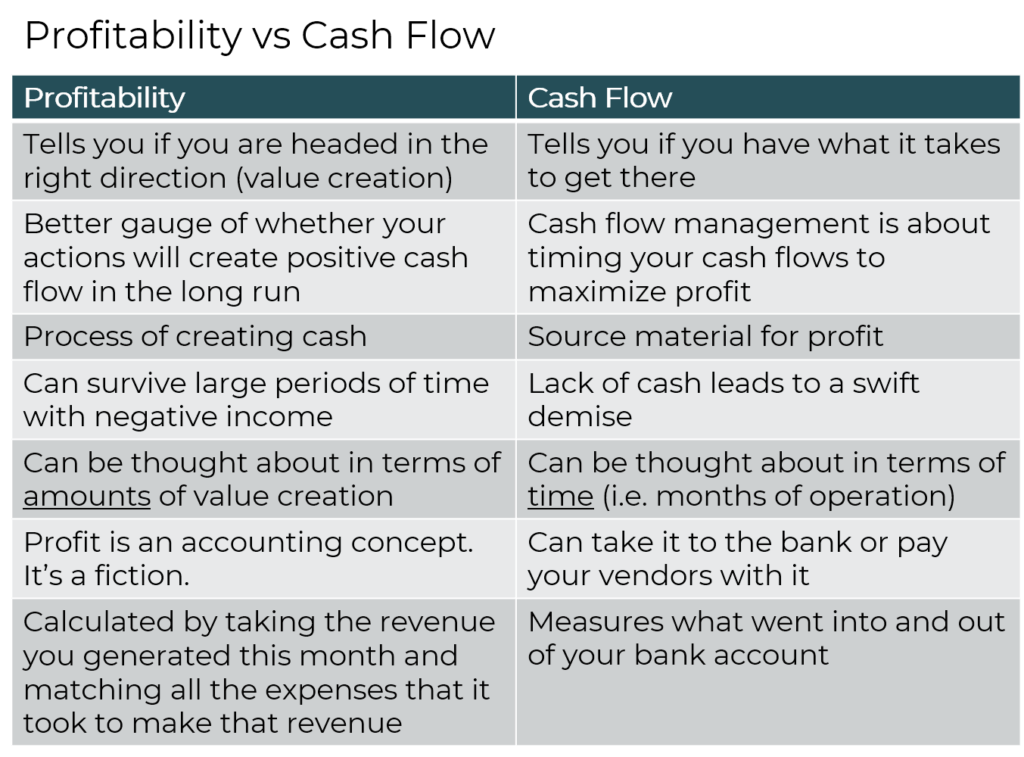

Profitability tells you if you are headed in the right direction of value creation. Cash flow tells you if you have what it takes to get there.

Value creation ultimately creates cash, but it may be a long time before you retain large amounts of that cash. Profit is a better gauge of whether your actions will create positive cash flow in the long run. Cash flow management is about timing your cash flows to maximize profit.

An Example of Profit vs. Cash Flow

Let’s say you built 100 widgets at a total cost of $80,000 and sold them for $100,000. Congrats! You just made a $20,000 profit! Now let’s assume you paid for the cost of goods when you ordered them. Your invoices to customers said their payment was due in 30 days. Your cash flow for your first month during production is negative $80,000. Ouch! The following month, you receive the payments from your customers, so your cash flow spikes up to $100,000. That dip followed by a spike may not be a problem for a small amount, but if you had a shot at a $2 million profit opportunity could you find $8 million to pay for the cost of goods to capture it?

Access to cash means access to opportunities. There are many profitable opportunities that require cash flow to capitalize on them. You can’t just think about what’s profitable. You must construct a system that creates the cash to keep your business engine running.

Let’s dig more into the differences between profit and cash flow. Measuring both cash flow and profitability is critical to your business’s success.

Cash Flow

You can survive large time stretches with negative income, but a lack of cash leads to a swift demise. Ironically, times of fast income growth can be when cash flow is stretched the most. The more you want to make big moves, the more you need to be able to plan your cash flow.

So, high net cash flow is always good, right? No. It takes money to make money. High net current cash flow may be caused by insufficient investment for future cash flow. You need to upgrade equipment and hire staff.

There are two extremes in managing cash distributions to owners:

- The Cash Cow: Cash cows give owners lots of cash. You can back off on investment and reap cash from the company for your personal needs. This maximizes your current personal cash flow, but that cash is not available for the company to make high future returns for you. Your company is often your highest-producing investment.

- Growth Maximization: You don’t take a dime from the company and plow every cent back into the company to maximize future earnings. Assuming the company is profitable, this will create the largest increase in your net worth in the long term.

Some owners use their company as a cash cow in later years. This is OK if you need the cash for personal expenses but diminishes the future value of the company. This is not a problem if you plan to wind down the company. The decrease in future value is a much bigger problem if you plan to sell the company.

A good example of where cash flow differs from profit is large investments in equipment, software, or buildings. The purchase causes a massive hit to cash, but after that you show positive cash flow produced by the investment. The cost of that big purchase is allocated to multiple periods of revenue on your income statement. The cost is therefore matched to the future revenue generated by that investment. This gives a more accurate picture of the return on that investment.

Think of profit in terms of amounts of value creation. Think of cash flow in terms of time. For example, if you receive a large cash inflow, you then plan how long it will take your company to use that cash. Is that time frame shorter than the next major inflow of cash? If so, you need to identify additional sources of cash.

A key aspect of cash management is called liquidity contingency planning. Liquidity contingency planning is just a phrase that means, “How do you make sure you can get enough cash (a.k.a. liquidity) when everything goes wrong?” You likely have one major source of cash, which is usually sales. It may be very volatile. Your expenses are likely pretty much the same amount each month. A cash crisis occurs during periods when low cash inflows from sales don’t cover your fixed monthly cash needs for expenses. Good cash flow projections and planning can help with that.

Defining Profitability

Profit is an accounting concept. You can’t take it to the bank or pay your vendors with it. So, what do accountants have against using cash flow to measure income?

Gaming your results on financial statements is easy if you use periodic cash flows to measure profit. For example, you could take in a lot of cash from sales but delay paying your expenses. You would look really good from a cash flow perspective until you had to pay those expenses.

That example also shows how volatile cash flow can be. Imagine your accountant came in one month and declared you were incredibly successful based on cash flow. They then came in the next month with the horrible news about massive losses. What could you believe? What’s the truth?

It’s hard to tell if you ultimately made positive cash on that sale. That’s critical information to know. You don’t want to keep selling at a loss. It eventually leads to losing your cash. That’s the beauty of profitability analysis.

Profit is calculated by taking the revenue you generated and matching it with all the expenses that it took to make that revenue. Cash flow just measures what went in and out of your bank account. Profit measures value creation.

Profit is the process of creating value. Cash flow measures how much of the precious resource of cash you create or consume over a period of time.

Profitability is the measure of how many dollars you can produce from one dollar. In the classic movie It’s a Wonderful Life, the financial institution run by Jimmy Stewart ends the day with only two one-dollar bills. He titles them mama and papa dollar and encourages them to create more dollars as he puts them to bed in the vault that night. Profitability measures how many dollars your processes help mama and papa dollar birth.

Profitability is an excellent long-term measure of the effectiveness of a process. The process ultimately produces or loses cash. Profitability analysis measures the amounts of this. Profitability analysis allows you to decide between options based on their ability to create value. In other words, positive profitability shows that you are creating value. You ultimately receive that value as cash, but profitability analysis does not tell you when you will receive that cash.

Cash flow vs. revenue

Revenue and cash flow are also often confused. It’s true that cash-basis companies revenue when they receive the cash flow. This is a simplification for tracking that lets you record the revenue and the cash flow at the same time, but they are actually two different things.

Accrual-based companies record revenue on the date it’s earned and cash on the date it’s received. Revenue is the income you earn by providing goods or services. Accounts receivable is cash that’s due to you because of the revenue you earned but has not yet been paid. The day you earned this revenue and when you actually receive that cash flow could be days, weeks, or months apart. Sadly, you sometimes never collect the cash.

I wanted to make this quick explanation of cash flow vs. revenue because they are so often confused, just like profitability and cash flow. I go into much more detail about the time from a sale to the collection of cash on that sale in this article.

What Does Creating Value Mean? How Does it Relate to Profitability vs. Cash Flow?

I’ve talked about value creation throughout this article. Your company is a collection of processes that create or lose cash. If it creates cash, owners can take cash from the company over time to use on what they value. It may be for travel, for your family, or to put in savings for a secure future.

As someone trained in financial therapy, I understand that there is a vast meaning behind money. It’s not about the dollars. There are beliefs and dreams in those dollars. I talk more about a comprehensive definition of value creation in my article on how value creation leads to business success.

For purposes of this article, I will use “value” in a more traditional accounting or economic sense.

There are a couple of ways to measure the value of those cash flows:

- Owner’s Equity: Your balance sheet ends with a section titled “Owner’s Equity” and one of the standard financial statements is the “Statements of Owner’s Equity.” Owner’s equity is simply the difference between the value of your company’s assets (i.e., what you own) according to the accounting rules less the amount of your liabilities (i.e., what you owe). One of the main ways your owner’s equity goes up is through the profit as measured by your income statement.

- Business Valuation: The other way to measure value is to receive a business valuation analysis. This is often done when owners are considering selling their company. The valuation expert will look at both your earnings and cash flows to estimate what your company may be worth to a buyer.

I’ve talked about times when cash flow and profitability can show different results. There are times when both cash flow and profitability are negative, but you are still building value. Startup company companies are a perfect example. They don’t have enough revenue yet to cover their expenses, but those expenses are building the processes that will produce future cash flow and profits in the future. In this case, the amount of owner’s equity on the balance sheet may be going down, but a business valuation might show an increasing value for the business.

The False Debate of Profit vs Cash Flow

The debate over the importance of profit vs cash flow fails is a false debate. They measure different but related things and are both extremely important to your business’s success. Profit is the difference between revenues and the expenses required to produce those revenues. Cash flow is the difference between cash received and cash distributed in the period. Over long periods, they are similar. Over shorter periods, they can be very different

For more info, check out the cash flow topic page.