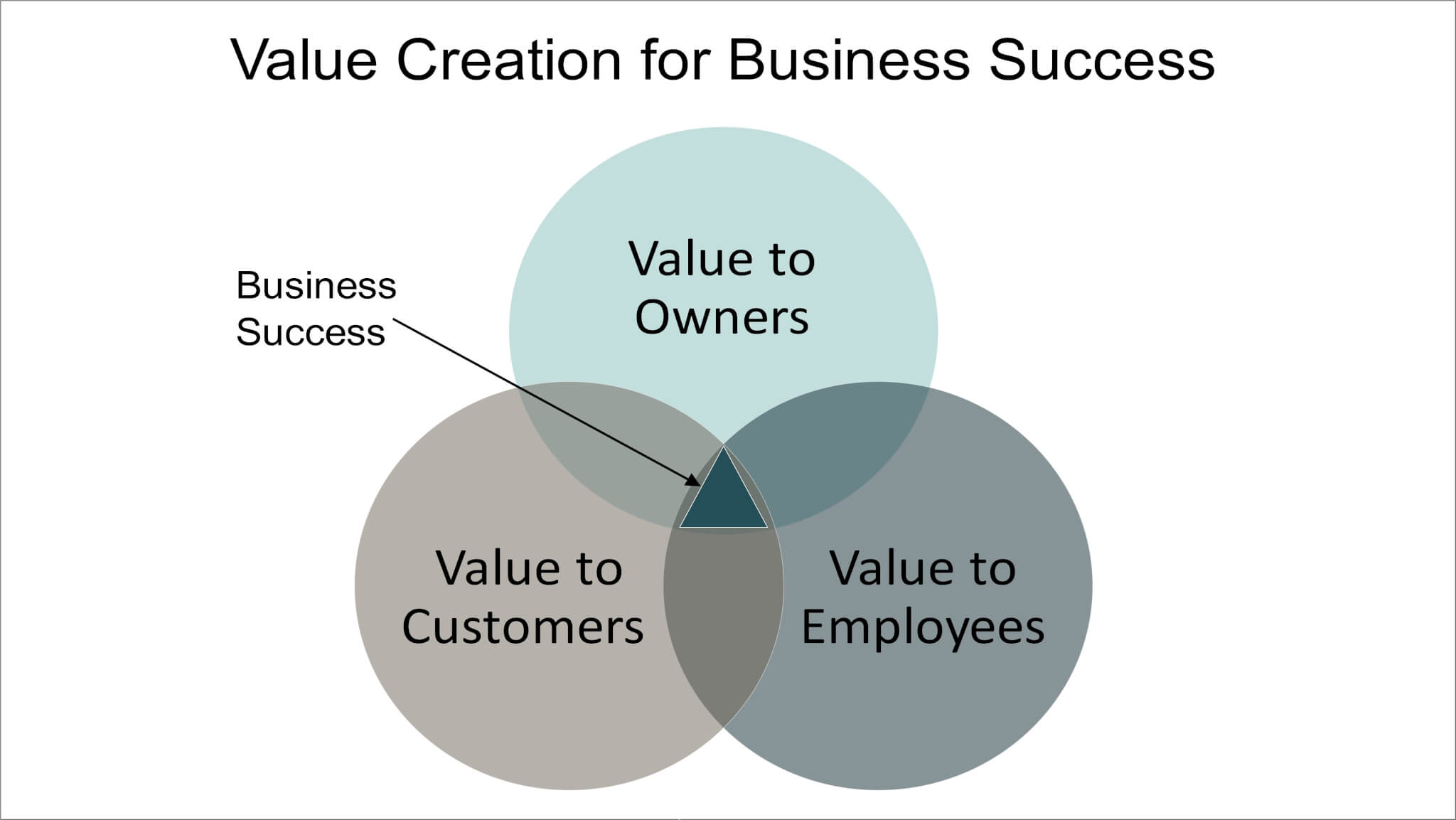

Business success comes from value creation for owners, customers, and employees. Value is being built or destroyed throughout your business.

What’s the purpose of your business? Some would define it as profitability, cash flow, security, or freedom. The purpose of a business is to serve the values of you as the owner. Its purpose is value creation for the owner. This can become easily lost in the day-to-day management of the company.

What you value may change over time. For example, once your company achieves a certain level of cash flow, you may want more time or a more flexible schedule.

Let’s define value creation and explore ways your company can create more value for you.

Value creation definition

The definition of value creation is giving something valuable to receive something else that’s more valuable to you. This definition is broad and captures both costs and benefits. Further, it applies to owners, customers, and employees, as I’ll describe later.

Isn’t it just profitability? It might be for shareholders of large businesses but becomes less true for small businesses. A shareholder of a large business may only care about profits. It’s a component in their investment portfolio and its only role is to enlarge their wealth.

Some investors have gone beyond that to impact investing and want more than just income from their investment. This has led to the rising popularity of B-corporations. Impact investing and B-corporations balance financial returns with producing a public benefit. They are driven by both mission and profit.

It may be how you can live out your values or achieve goals you couldn’t do individually. You may want time or freedom. It may be your status or position in the community. Owners often have a deep devotion to employees and are willing to provide for them even if it means reduced profits.

Clarifying your values takes work. I go into detail on how to do this in my blog article on how business goals move you from distraction to direction. In that article, I provide exercises to:

- Identify your life aspirations

- Develop the primary aim of your business

- Develop goals that focus your company on achieving that primary aim.

Company owners, customers, and employees can define “value” in many ways. In my Creating Value program, I guide you through determining how each defines value.

Value creation for customers

You get value when you give value. Your business will only succeed if you provide great value to both your customers and employees. Think of it this way:

Businesses fail when they can’t produce value for both owners and customers. I’ll explain later in this article how to create value for employees.

At one extreme, you could create a product with high value to you, but customers don’t see a need for it. You don’t make sales, which means you don’t create much value for you.

For example, a business owner could create a high-tech gadget at a high price. It’s a business failure if customers aren’t willing to pay the price or don’t see a need for the device. These owners aren’t serving their customers, and they aren’t earning profits. They haven’t created value.

The other extreme provides value to customers but no value to owners. Owners do this when they provide their services or products at prices near or below their costs. The company is very busy making little profit or cash flow. This owner would need to find some other source of value to justify this. This may be viable if it’s part of a larger pricing strategy that provides profits later. I talk about this in my pricing strategies article.

I’ve been asked many times to analyze a product or pricing strategy that they know will be very popular with customers. These products often devastate company profits. Financial analysis has proven many “great ideas” to be earnings disasters.

You get value when you give value

It’s easy to be caught up in the excitement of a potentially great idea. Take time to challenge it and do a financial analysis on it. I talk about how to do the financial analysis in this article.

Common selling wisdom is to sell benefits and not features. People care most about how their life will be better. The features are just proof that your product or service can deliver the benefits.

Carmine Gallo, the author of Talk Like TED, summarizes this as “Sell dreams, not products.”

In an Inc. article titled “The Hidden Reasons Why Customers Buy Your Products,” Katlin Smith states, “People make purchases that fit who they are or who they aspire to be (or both). Who are your customers? Who do they want to be? Determine this. Keep it in mind at all times.”

Where value creation occurs

You can create value throughout your company. It doesn’t just happen when you sell your product. It starts with how you structure your company. Value creation continues with how you build your product or provide your service. It’s completed with the sale.

Value creation from how you build your business

Committing to what’s best

Many owners want too many good things because they haven’t committed to what’s best. You can’t have it all. An old saying is, “The person who chases two rabbits catches neither.” Wouldn’t it be better to get the largest amount of what you want the most?

I talked earlier in this article about clarifying your personal aspirations and the purpose (or aim) of your company. The rubber meets the road of that purpose when you commit to it at the expense of all else. Saying yes to everything means saying no to large amounts of what you value most. You must commit and be willing to make the tradeoffs.

Clarity of purpose produces elegant simplicity. As the saying goes, “When your vision is clear, the decisions are easy.” You aren’t wasting your time, energy, or money. Your company focuses on providing that profitable overlap of what you value and what your customers value.

Your supportive team

You don’t achieve your goals alone. You need the support of mentors, contractors, and employees. All but the smallest companies rely heavily on the support of their employees.

We can’t just provide value to our customers to succeed. We must also provide value to our employees.

Is this value just having a job and getting a good paycheck? It’s enough for getting their bodies to show up for work but not their hearts and minds. They’ll give the minimum when they’re given the minimum.

Effective employees want purpose, not just paychecks. You want employees that are internally motivated to provide value for your customers. That sense of purpose and accomplishment energizes them.

Effective employees want purpose, not just paychecks

Money is a weak motivator. In research done by Sylvia Hewitt, she found that both Boomers and Gen Y found motivators like “a great team” and “the ability to give back to society through work” to be more important than money.

An excellent exercise to understand what employees value is a Stop-Start-Continue exercise.

Value creation from buying or building assets

You often create the bulk of your profits before you make a sale. There’s a saying in real estate that the profit is made when you buy – not sell – a property. This means there is more opportunity for profit by finding underpriced properties than the ability to sell at a premium.

Many bankers, especially lenders, think loans provide the biggest profits for banks. Banks get most of their revenue from loans. Yet the price of bank stocks is driven by the strength of that bank’s deposits more than its loans. The market values deposits more than loans.

It’s easy to link value to when you see the cash. It’s easy to confuse activities that produce revenues as creating the bulk of the value. In the banking example above, loan interest is income to the bank and deposit interest paid to depositors is an expense. How can something that causes expenses be more valuable than what creates income?

The key is to think of your business as a complex system of value creation processes.

One way to think about it is to break the whole system into pieces by imagining each process being its own company. Which processes are more stable and profitable? Where are the opportunities? There are a couple of ways to estimate this:

- Estimate the profit as the cost of each process compared to the increase in the value of the product from that process.

- Compare your cost of a process or product to industry averages. Greater efficiency creates greater profits.

For example, banks can invest in anything and still make a profit when they find cheap deposits. When they have expensive deposits, the only way to make a profit is by finding higher yields. That may cause them to make riskier loans with higher yields, which is dangerous.

It’s easy to miss where you’re creating value when you’re just looking at sales. You can create profits by both lower costs and higher revenue.

Value creation from sales and marketing

Selling communicates value to customers so they recognize it and are willing to pay for it. Profits come from both the creation of value in production or service delivery and the communication of value through your sales process.

A good sales process can do two things:

- Communication: Some products are said to “sell themselves”. In these cases, focus your sales dollars on getting the word out as broadly and clearly as possible at a low price. Customers must understand the value you can provide to them to pay what it’s worth.

- Creation: You create value in your sales process by improving what people believe about you and your product. The product is still the same, but sales increase because your customers perceive a higher value.

The sales function can be your biggest missed opportunity. You could create great value in the product or service but underinvest in marketing. Never underrate the power of building a brand. Do the work to build the trust and knowledge customers need to be willing to buy.

The opposite mistake is to waste dollars on a sales process that provides little value. This usually occurs when owners see sales revenue but don’t know what’s driving it. They haven’t learned what their customers truly value. Driving blindly, they continue to pour money into sales staff and marketing to keep the sales going.

“Half the money I spend on advertising is wasted; the trouble is I don’t know which half”

John Wanamaker

John Wanamaker, a successful business owner from many years ago, is credited with saying “Half the money I spend on advertising is wasted; the trouble is I don’t know which half”. Do you feel the same way?

Sales staff are usually very highly compensated. This means there must be a large creation of value at the sales stage to justify the expense. Otherwise, you’re destroying value (losing money) in your sales process. Here are ways to determine whether you’re creating value through your sales and marketing process:

- Higher profits: Are your good sales staff profits well above your weaker salespeople? Make sure you’re measuring profits and not sales. Some salespeople are better at convincing their company to sell at a lower price than convincing customers to buy at standard prices. Salespeople that can create larger profits are creating value for your company.

- Repeat Sales: Identify the salespeople or marketing channels that lead to repeat sales. They haven’t just made a sale; they’ve created loyal customers.

- A/B Testing: You can experiment to see what increases profits. A/B testing is the process of comparing the results of two different sales or marketing strategies. You can learn more from this article on LinkedIn.

Incentive pay is popular for sales staff and managers. These incentives are sapping the productivity they were meant to promote.

Daniel Pink, in his insightful book Drive, states that monetary “rewards can deliver a short-term boost [to interest and productivity]… but the effect wears off- and worse, can reduce a person’s long-term motivation.”

The London School of Economics did an analysis of 51 studies of financial incentives. Here are some quotes from their conclusions:

- “Performance-related pay often does not encourage people to work harder and sometimes has the opposite effect”

- “We find that financial incentives may indeed reduce intrinsic motivation and diminish ethical or other reasons for complying with workplace social norms such as fairness. As a consequence, the provision of incentives can result in a negative impact on overall performance”

- “Companies should be aware that the provision of performance-related pay could result in a net reduction of motivation across a team or organization.”

The sales and marketing process is when your customer first learns the value you can provide to them. You may be creating or destroying value to the owners by how you invest in this area.

Looking for Value

I was the CFO of a bank and would get frequent calls from a bond broker. When I would ask how things were going, he would often reply, “I’m just looking for value.” We can say the same for ourselves as business owners.

We’re constantly looking for ways to provide value to our customers and employees. When we create value for our employees and customers, they provide value to us as owners. A company’s purpose is value creation for owners.

For more info, check out the following topics pages:

Get ALL the Courses Plus More in One Package

FAST (Finance and Strategy Toolkit) is the membership program that gives you resources for better strategic financial management. You get all the CFO Perspective courses. Get direct access to me as well as tools for improved decisions that can lead to improved performance.

The right tools can save you time, reduce your stress, and improve your effectiveness.