A quick price analysis will significantly increase the profitability of your pricing strategies.

Every business owner wants to find pricing strategies that maximize their profits. Once you know the prices of your competitors, do you know how to set your price to maximize your profit? Let me show you how to estimate how your price change might impact your profits.

Pricing as Art and Science

I’ll be the first to acknowledge that pricing is both art and science. Before we get into some of the science, make sure you don’t make short-term pricing decisions that damage long-term relationships. Solid relationships provide stable revenue and high profits.

You may think you know your most profitable customers. I’ve built customer profitability systems that showed that some were the least profitable. These are large customers that have received multiple large price concessions. The art is finding the right price that’s fair to everyone in the long run.

Every Action Has a Reaction

Your analysis must include your best guess of what the competition will do in reaction to your price change. Let’s say you lower your price. Your competitors may match your lower price to maintain their market share. Your competitors have now taken away your growth, leaving both of you with only the losses of a reduced margin. Welcome to a price war where everyone loses.

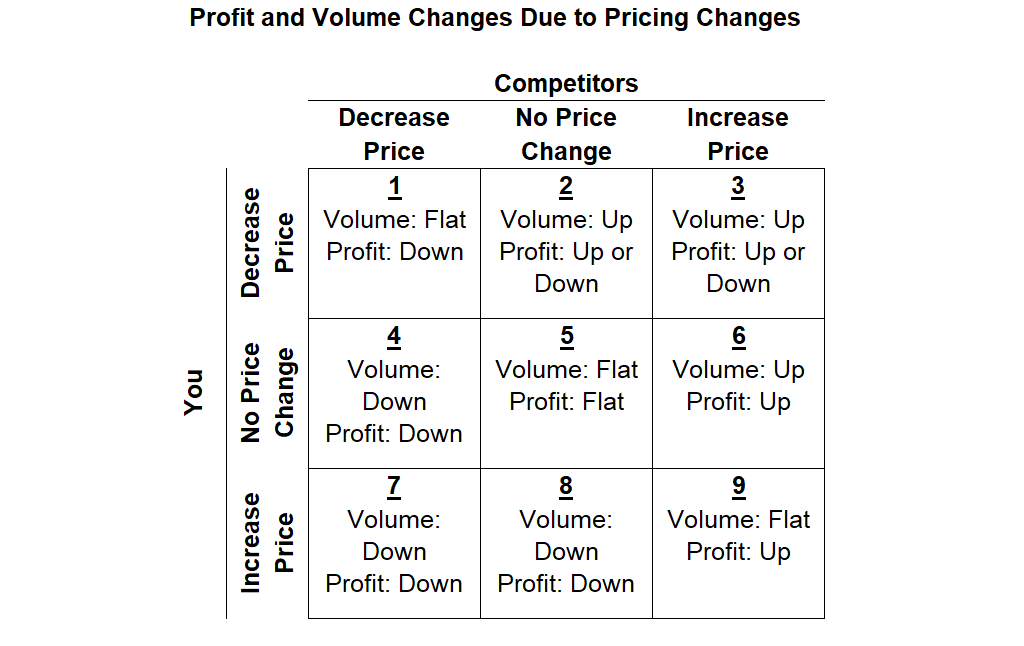

In a way, pricing is a game of cat and mouse. One company makes a move. The other companies respond. Another company makes a move. The other companies respond. The pricing matrix below clarifies what may happen after each move and what your options are at each point.

The Pricing Matrix

Below is a basic matrix of price change options. You can decrease your price, leave it unchanged, or increase your price. Your competitors can do the same. This creates a set of nine options summarized in the table below.

This table assumes that your variable costs are less than the price of your product. Sometimes you cut your price below your cost. This is especially true with a loss leader. In that case, you lose more money on that product for every unit you sell and must make it up with increased sales or profits on other products.

The impacts on volume and profits from these price changes are generalities. Your profit could go up or down in many scenarios. I’ll explain how that can happen later in this post.

Walking Through a Price Increase

Let’s assume your competition raises their prices, but you haven’t yet changed your price. You’re now in box #6. Your profits will likely go up as price-conscious customers choose your product.

You could stay in box #6, but you may make more profit by also raising your price. Now you have moved to box #9. Why would you do this? You give up the higher volumes and the margin they bring, but you increase the volume on all your existing sales. This may be more profitable than staying in box #6.

Who Are the Customers You Gain or Lose?

A crucial consideration is whether the customers you attracted are valuable over the long term. They may have low loyalty and choose only on price. You will lose them whenever one of your competitors lowers their price. However, sometimes it’s a good strategy to stay in box #6 for a while to attract a few of these customers. This works if some will try your product and become loyal.

The Worst-Case Scenario

Everyone loses in Box #1. It’s a price war. Everyone’s chasing volume with price reductions may be a race to the bottom in a war of attrition. The few survivors end up much weaker. The market has become used to the lower prices, making it very hard to raise prices again.

Think very hard before chasing a competitor who has decreased prices. You may lose more margin on your existing customers than you gain trying to retain a few price-sensitive customers. You’re usually better promoting the value of your product than chasing price. Chasing price teaches your customers that everyone’s products are the same so they should just choose the lowest price. Never undersell your value.

Key Factors of Whether Your Pricing Strategies Will Be Profitable

Cannibalization

Cannibalization is an overlooked massive hit to profits. It’s the difference between a higher and lower price of a product multiplied by the number of units you could sell at the higher price.

For example, let’s say you usually sell your widgets at $100 but you lower the price to $90 to drive growth. If you normally sell 1,000 widgets, your profit dropped $10,000 ($100-$90=$10 X 1,000). Do you know how many more widgets you need to sell at the lower price just to recoup this lost profit? My template tells you that with the breakeven analysis I’ll talk about later.

Keeping your prices low is cannibalization as an opportunity cost. You have the opportunity to raise your prices and profits. In the price increase example above, your profits might go up if you moved from box #6 to box #9 (i.e. raised your price to match your competitor). Your profits would go up if you get a higher price on all existing customers that’s more than the cost of losing a few customers. This gets back to why selling value and creating loyalty are so important. You can raises prices while limiting lost sales.

Marginal Costs

Maybe your accounting records or a profit analysis shows your average cost per product. DO NOT USE THIS TO PRICE YOUR PRODUCT. This is such a common mistake. The only relevant costs are the actual costs you save or incur by changing your price. Past costs are irrelevant “sunk costs” to your decision. I have a whole post about marginal profitability analysis to learn more about this.

Step Fixed Costs

Some costs, like materials costs, go up with each unit produced. They are like the ramp on the right side of the picture above that increases with every step you take up the ramp.

Other costs, like machine costs, don’t go up with each unit but once you reach your machines’ capacity you have to buy a new machine. Hiring another full-time employee is another example of a step fixed cost. They are like the steps in the picture. Sometimes you walk forward without going up a step, and other times you need to take a step up.

The pricing matrix assumes that you don’t have to incur a step fixed cost or don’t have a step fixed cost savings with any of these volume changes. This is usually true with small volume changes. When volumes change dramatically, the general assumptions of this table may not hold. Major changes to your pricing strategies require analysis.

Excess Capacity

Capacity is closely related to marginal costs. Excess capacity allows you to increase volumes without significant cost increases. You don’t have to buy new equipment or hire staff for that production growth. Pricing strategies that increase sales are likely more profitable if you have excess capacity.

Conversely, reduced volumes can hurt profits if you have excess capacity. If your marginal cost per unit is less than it’s price, you are losing profits when volumes go down. In this case, you would choose pricing strategies to keep volumes up.

Choosing the right pricing strategies when you don’t have excess capacity requires careful analysis. Increased capacity usually requires a large step fixed cost investment of equipment or staff. You need to determine whether you will make enough profits on the increased production to cover the step fixed costs.

Calculating Changes to Profits Due to Changes in Price

It’s not enough for sales to go up when you grow. Increased sales can cause profits to go up or down. The sales revenue must increase more than the increased cost of growth. You calculate this with a price change analysis. This is also called a marginal profitability analysis. To do this:

- Calculate your current profit

- Calculate projected profit after growth

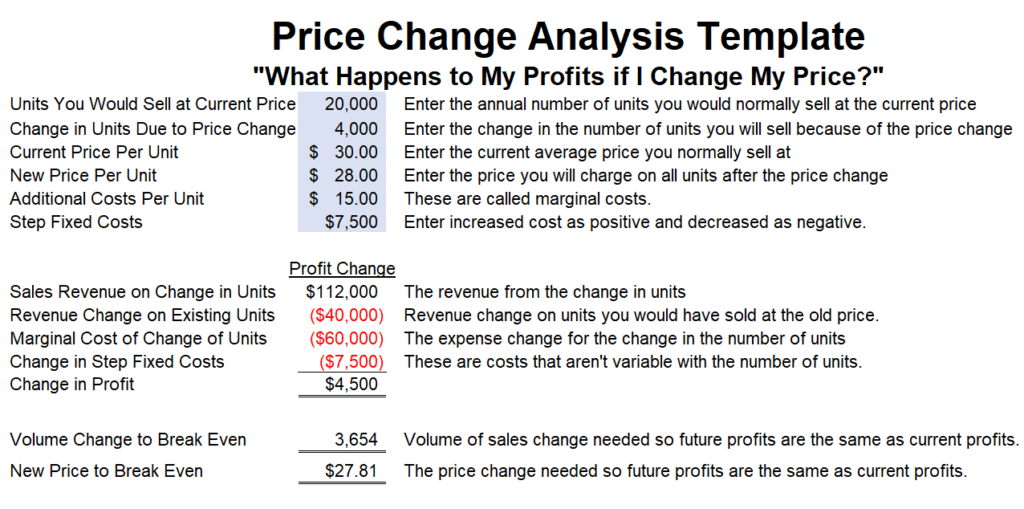

The difference between #2 and #1 is your marginal profit by growing. I’ve also created an easy-to-use worksheet template for to calculate the change in profits due to a change in prices. While simple, I use it when I teach entrepreneurial finance classes to MBA students at a university. It’s also available in my Pricing course and to FAST members.

The Excel price change template looks like this:

You enter your assumptions of sales volumes, prices, and costs. The analysis calculates:

- the change in revenues from the change in sales

- cannibalization of your current sales

- your changes in costs

The sum of these is your change in profit.

The concern I usually hear when working with someone on this is that they don’t know how much their volumes will change when they change their prices. That is true, but you may have an idea of the range of volume changes.

One option is to start with your best guess and then refine as you go. Another option is to model the low and high amounts of the potential range of volume changes to see how comfortable you are with both. Competitors will respond to your actions, so adjust your sales forecast to reflect their response. If you have absolutely no idea of your projected profits, then do a breakeven analysis.

The breakeven analysis is one of the most powerful features of the price change analysis template. It calculates the breakeven amounts for both volumes and price. A breakeven analysis calculates the revenue increase you need to cover your expense increases (i.e., how much revenue you need to “breakeven”). You can then evaluate whether you think that “breakeven” revenue increase is reasonable.

The Excel analysis calculates:

- The change in volume you would need to break even at the price you modeled.

- The new price you would need to charge to break even at the volumes you modeled.

You may find that you would have to grow revenue much more than you think. This often happens when you lower prices. The profit on what you would have sold drops and must be recovered by profits on increased sales. I explained this in more detail in the section above on cannibalization.

From Analysis to Action

Many business owners take a “ready, fire, aim” approach to pricing strategies. Improve your speed and accuracy of aiming price changes with my price change analysis worksheet.

For more info, check out these topics pages: