Don’t Use Historical Profitability Analysis for Forward-Looking Decisions

You’ve heard for years that you needed to perform product profitability analysis to know which of your products made or lost money. Maybe you finally calculated the profitability of each of your products. Congrats! That’s a good start.

Just don’t use them to decide what you should promote going forward. You need to use marginal costs, not allocated historical costs. Let me explain.

Why Many Profitability Numbers Provide Little Actionable Data

First, let’s quickly clarify the standard product profitability formula and a few problems with that data for decision-making. It starts with sales income for each product. Costs directly related to your product or service (also known as “direct costs”) are then deducted. Overhead costs (advertising, insurance, accounting, building costs, etc.) are then allocated to each of those products.

So here’s a recap of the standard product profitability formula:

Sales Income

Less: Direct Costs

Less: Allocated Costs

Equals: Product Profitability

Where most people make mistakes is how they use these numbers. Here are some problems with that analysis if you are trying to decide what product to promote.

Historical Numbers

Most profitability analysis starts with historical prices and costs. Past sales price, cost of goods, salaries, competitor prices, and customer preferences may have been totally different than they are now or will be in the future.

Allocated Costs

Overhead costs that have little to do with future profitability are often allocated to products. Will your overhead costs really go up if you sell 100 more units of your product? The way they are allocated to products is often almost arbitrary. This can seriously mask the true direct profitability of the product. Allocating overhead to products often muddies the waters on the relative profitability of different products.

Sunk Costs

A sunk cost is defined by Investopedia as “a cost that has already been incurred and cannot be recovered. A sunk cost differs from future costs that a business may face.” They further state, “Sunk costs (past costs) are excluded from future business decisions.” Let’s say you bought a piece of equipment that can produce 1,000 widgets per year and you are currently only producing 700 widgets annually. If you can sell 200 more widgets, your additional equipment costs are almost zero because you are using the excess capacity of your machine. If you can sell 400 more widgets, you will need to buy a new machine. The costs of those two decisions are totally different. Standard product profitability uses the cost of your current machine, which is a sunk cost. Marginal profitability looks at whether you need to buy a new machine.

Average Costs and Prices

The profit you make by selling $100,000 more of a product may be totally different than the average profit on the $1 million you sold last year. It could be due to cost differences as noted above. You may be able to sell the product to a new customer at a different price than your current customers.

The Big Question

The problems of standard profitability numbers became clear to me by a question I received from a commercial banking officer. I had built a customer profitability system for a bank. My job was to then train all the commercial banking officers on it. I was showing the system to an officer who said, “This is interesting, but what am I supposed to do with it?”

He had a point. I was able to rank all his customers based on their past profitability. There were some decisions that could be taken based on this information, but a marginal product profitability analysis would be much more effective. His question drove me to create a system to model the projected future profitability of a customer. This provided much more useful information.

The Benefits of Marginal Product Profitability Analysis

Marginal profit is the additional profit you would make by selling additional products or services. The marginal profit formula is:

Sales income of additional product or services

Less: Increase in total costs because of additional products or services

Equals: Marginal profit

Using marginal profitability analysis to make decisions has two key benefits:

- It’s simpler. The standard product profitability analysis requires capturing all your costs and then allocating them to products. You can calculate the marginal profit by identifying only the increase in your total costs. Those numbers are often much easier to determine.

- It’s actionable. Decision analysis explores your options for the future, not what you’ve done in the past. Standard profitability analysis calculates historical averages of past sales. Marginal profit analysis helps you decide what’s the most profitable thing to sell next.

A Quick Example of How Marginal Profit Analysis Helps You Make Good Decisions

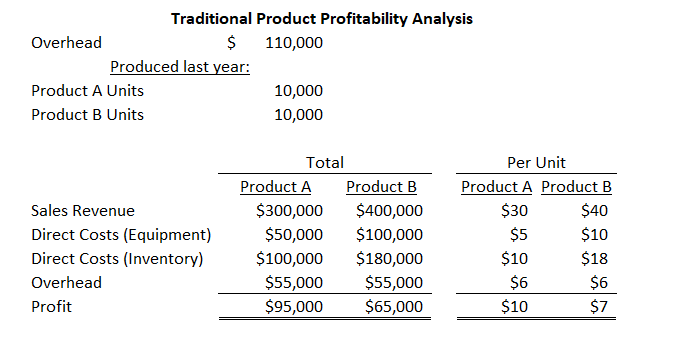

Let’s assume you produced 10,000 units of Product A and Product B. You did a standard product profitability analysis which is in the table below. In this analysis, Product A shows a profit of $10 per unit and Product B shows $7 of profit per unit.

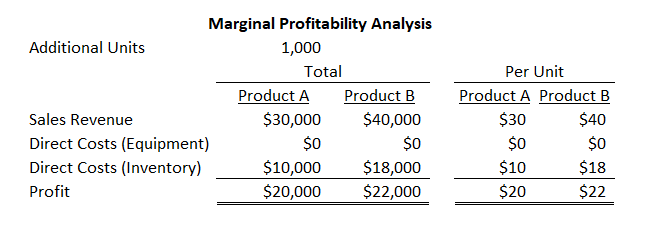

Now assume you could sell 1,000 more units of one of these products at their current price. You have excess machine capacity to run either of these and producing 1,000 units won’t increase your overhead. Which product would you pick? Would you pick Product A based on its higher product profitability from this analysis? Let’s look at the marginal profit for these products:

The marginal profit is $20 per unit of Product A and $22 per unit for Product B. Now which would you pick? The profitability of these flipped because there is no marginal cost to using your excess machine capacity. Product B is the better choice in this scenario. Standard product profitability analysis would have steered you wrong.

When to Use Marginal Profitability Analysis

You can see why marginal profitability analysis provides better information for decisions. Let’s look at some common decisions where it’s useful:

- Deciding which products to promote: The example above showed how marginal analysis can be used to decide which of two products to promote to maximize profits.

- Setting pricing: Marginal analysis is the starting point to determine the optimal standard pricing for your product. Marginal analysis is very useful for setting pricing when you have the opportunity to sell to new markets or customers.

- Planning equipment purchases or staff increases: Knowing the capacity of your staff and equipment combined with marginal analysis tells you when you can buy equipment or add staff. The analysis shows the breakeven sales you would need to cover the costs of new equipment or additional staff.

Ask the Right Questions to Get the Right Answers

Financial analysis for decision-making starts with clarifying the question you want to answer. Which of the questions below is the better question to ask when you are deciding what to sell or how to set your pricing?

- What was the average profit for the products I’ve produced in the past?

- What is the most profitable mix of products to produce next year for the capital I have to invest?

Standard product profitability will give you the answer to question #1. It’s interesting information but how useful is that to you? The better question is #2. Marginal profitability analysis provides the answer.

For more info, check out these topics pages.