Business and investment gurus tout how you can make big profits with little money of your own. They show how using other peoples’ money can make you rich.

It’s true that using other peoples’ money, known by the acronym OPM, can increase your returns. But OPM can also be like the drug opium. Its highs come with crashing lows.

Other Peoples’ Money (OPM) can be like the drug opium, with highs and crashing lows

Borrowing large amounts of money increases the risk that your business may run out of cash or have big losses in a downturn. I’ll explain how this works and how to reduce your risk.

Using Other Peoples’ Money to Boost Returns

Financial leverage is the use of borrowed money. Using other peoples’ money magnifies returns.

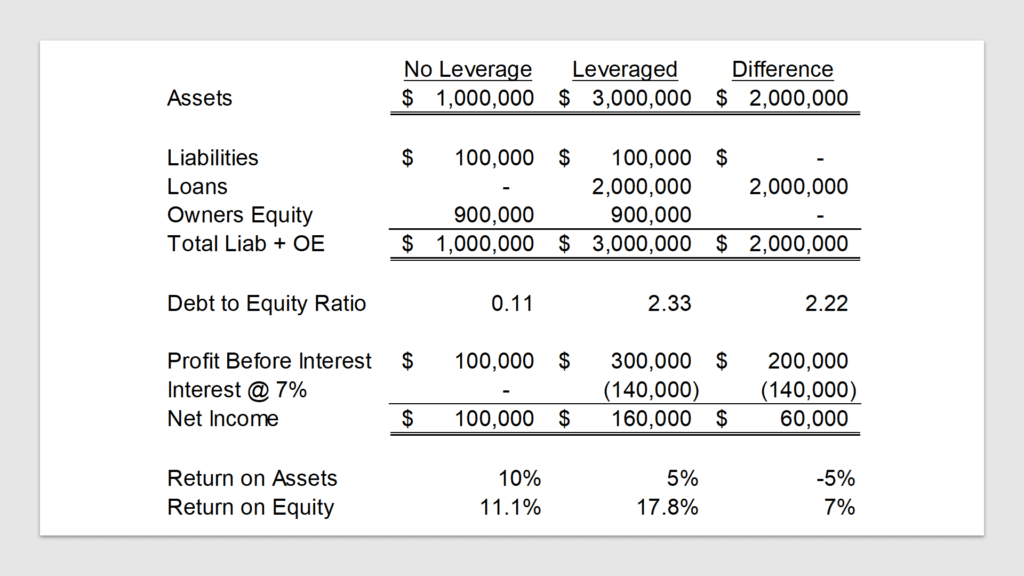

Here’s an example of using other people’ money that I’ll explain below:

In this example, the company has $1 million in assets. They have a few miscellaneous liabilities like accounts payable but no business loans.

Their profit is $100,000 so they have a return on assets, or ROA, of 10% and a return on equity, or ROE, of 11.1%. Return on assets is your income divided by assets. Return on equity is your income divided by your equity balance. They are ratios that measure your profitability.

The owners then decide to get bank loans (i.e., other peoples’ money) to invest in company assets to magnify their return on equity. This is the second column. They borrow $2 million, so total assets are now $3 million.

For simplicity, let’s assume they still earn 10% on their assets before interest costs. Their profit before interest expense is $300,000. Assume the loan has a 7% interest rate. They would pay $140,000 of interest expense, so their net income is $160,000.

Their return on assets decreased from 10% to 5% because they now have to pay interest on the cash they got to fund the additional assets. However, their return on equity jumped from 11.1% to 17.8%.

For this example, let’s assume net income is also cash from operations. They increased the cash they can invest in the company or distribute to themselves by $60,000.

In other words, other peoples’ money increased their ROE and cash flow to owners by 60%. The owners are making a lot more money. What could go wrong…?

When Other Peoples’ Money Leads to Disaster

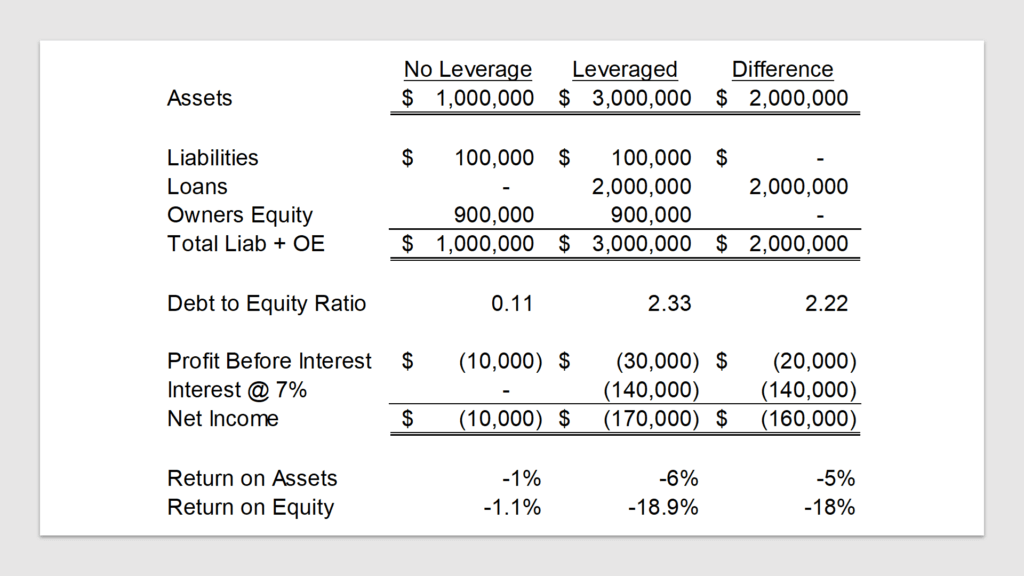

Leverage doesn’t increase ROE; it magnifies it. Using other peoples’ money to make you rich assumes a decent unleveraged ROA. A low or negative ROA can cause massive negative ROE and cash outflows. The dark side of using other peoples’ money is shown in the example above.

Our sample company is now earning a small loss. The first column shows their results with no leverage. They have a ROA of -1% and ROE of -1%. Their net loss is $10,000, which is probably fairly manageable with $1 million in assets and $900,000 in equity.

Now look at the leveraged column. They have three times as many assets, so their loss before interest is three times larger. A $30,000 loss may not hurt them too badly, but they also owe $140,000 in interest. Their ROA after leverage is -6% and their ROE is -19%.

Now look at the leveraged column. They have three times as many assets, so their loss before interest is three times larger. A $30,000 loss may not hurt them too badly, but they also owe $140,000 in interest. Their ROA after leverage is -6% and their ROE is -19%.

Leverage doesn’t increase ROE; it magnifies it.

A small negative ROA and ROE with no leverage has been magnified into a massive negative ROE through using other peoples’ money. Their ROE with leverage is 17 times lower than without leverage.

The biggest problem isn’t earnings; it’s cash flow. Companies fail from lack of cash flow, not lack of earnings. Most owners plow the full $2 million of borrowed money into non-liquid assets like real estate or equipment. Non-liquid assets are assets that cannot be easily sold or otherwise turned into cash. They may have even used some of their cash when they had only $1 million in assets as their down payment or equity portion of those illiquid assets. This company may not have the cash to survive a $170,000 loss.

As a banker, I saw this happen with many business owners during the Great Recession. Real estate investors and owners who made big expansions before the downturn were caught with little cash and big payments.

Using Other Peoples’ Money for Growth

Other peoples’ money can also lead to faster business growth.

In my article on the Hidden Insights in the Sustainable Growth Rate Formula, I explain how much leverage you’re comfortable with determines how fast you can grow.

An owner with a high tolerance for risk will want more leverage than an owner who places a high value on the safety and sustainability of the company. These two owners will have to negotiate a compromise.

You can download my free Sustainable Growth Rate Formula Calculator to see how using other peoples’ money can increase your growth rate.

Balancing Profit and Risk

You must balance both profit and risk when deciding how much to borrow and how to use the cash from that borrowing. Borrowing funds to increase your investment and grow your company can cause the return to owners to greatly increase. On the other hand, the return to owners is decimated if the investments start earning low or negative returns.

More important than the earnings is cash flow. When you have a decent income from your company’s investments, it’s not hard to cover your loan payments. You will need to have a good reserve of cash available for your loan payments when earnings falter.

Lots of gurus talk about using other peoples’ money while you make zero money down investments. It seems like cash flow magic.

It’s a lot less sexy to learn about liquidity management. Liquidity means how much cash flow you get from your investment, how durable those cash flows are, and what’s your backup plan when things get rough. Good lenders look at three sources of repayment when underwriting a loan.

Play it safe with liquidity because it dries up very quickly. Bankruptcy is a lack of liquidity, not a lack of earnings. The other people who loaned you the money can force you into bankruptcy when you can’t pay them back.

I encourage you to keep a larger reserve of cash as your borrowing increases. The increased borrowing increases both your profits and your risk. Over the long term, the reserve cash will allow you to keep most of the profits while reducing much of the liquidity risk.

Yes, Other People’s Money Can Make You Rich

It’s true that using other peoples’ money can make you rich. It’s also true that it can lead to bankruptcy.

Other peoples’ money is best used in moderation while keeping cash reserves. You’ll receive higher returns during the good times while covering your loan payments and losses during the rough times.

For more info, check out these topics pages: