The working capital formula and working capital ratio formulas are popular and easy ways to estimate your future cash flows. Lenders use it to judge your financial health.

Do you know how much net working capital you have? Is your net working capital ratio at a healthy level? How can you improve your working capital ratio?

I’ll answer all these questions in this article.

Definition of the net working capital formula

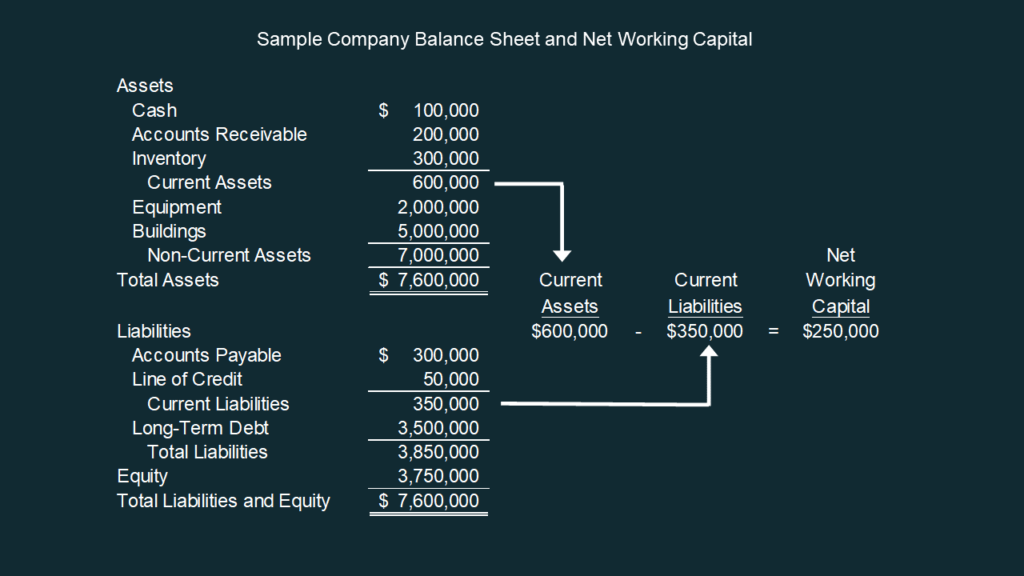

The net working capital formula is defined as current assets minus current liabilities. This is often simply referred to as the working capital formula.

It’s a simple definition but immediately leads to the question: “What’s a ‘current’ asset and a ‘current’ liability?

Assets are things you own or have rights to. Examples include cash, inventory, and accounts receivable. Liabilities are things you owe, like payments to your vendors or lenders. These items are listed on your balance sheet.

The word “current” means the asset will be converted into cash within a year or the liability will be paid within a year. “Noncurrent” assets and liabilities are all other assets and liabilities. Many accountants create balance sheets grouped into current and noncurrent sections. This type of balance sheet is called a classified balance sheet.

The above graphic shows a balance sheet with $600,000 of current assets and $350,000 of current liabilities. In this example, the net working capital formula is $600,000 of current assets less the $350,000 of current liabilities for a net working capital of $250,000.

What the net working capital formula tells you

The net working capital formula is a rough estimate of whether you will receive enough cash in the next year to pay what you owe in the next year. That’s why it’s used by lenders to determine whether you are financially healthy enough to receive a loan.

It’s one of the best and easiest ways to estimate if you have enough cash for the next year, but it has its weaknesses:

- It doesn’t include cash you receive from profits or cash you will pay for losses

- You won’t receive and keep the cash from some assets traditionally classified as current. For example, your accounts receivable and payable constantly get replaced with new ones, so they don’t provide as much cash as you may think. I’ll talk more about this later.

The net working capital formula is a good estimate for your future cash flow, but nothing is as good as a cash flow projection. Check out my article on how to create a cash flow projection for more information.

Definition of the working capital ratio formula

Closely related to the net working capital formula is the net working capital ratio formula. It’s often just referred to as the working capital ratio.

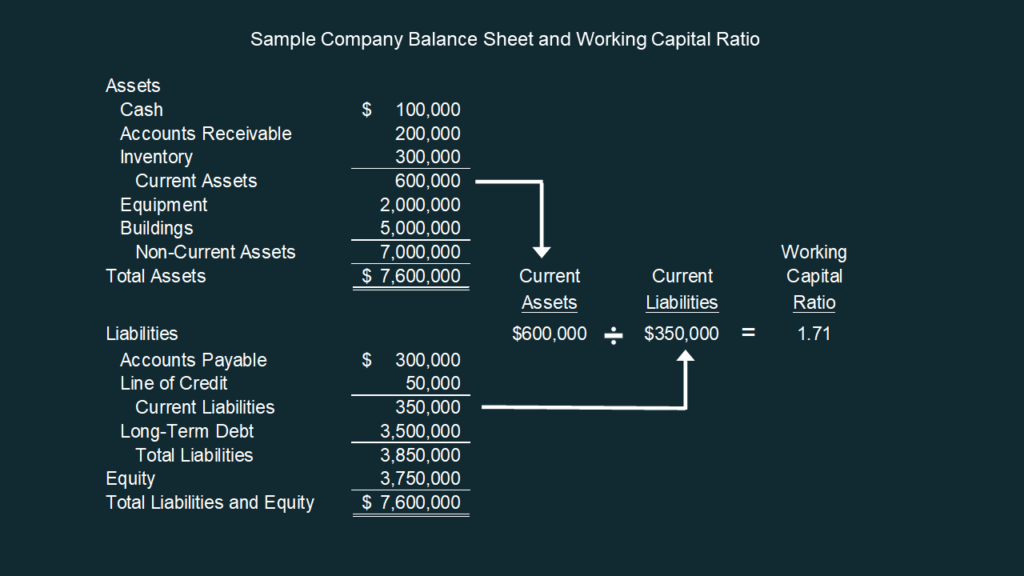

The net working capital ratio formula is: current assets divided by current liabilities.

Let’s use our sample balance sheet from above to look at this ratio.

The above graphic shows the same balance sheet as the earlier example. The net working capital ratio formula is $600,000 of current assets divided the $350,000 of current liabilities for a working capital ratio of 1.71.

The working capital ratio formula does a better job than the net working capital formula comparing the size of your current assets and current liabilities. For example, is $100,000 a good amount of net working capital? It is for a company with $100,000 in sales but wouldn’t be enough for a company with $100 million in sales.

Here’s a quick way to assess your financial health with the working capital ratio:

| If your working capital is… | It means your… |

| = 1.0 | current assets are as equal to your current liabilities. |

| < 1.0 | current assets are less than your current liabilities. |

| > 1.0 | current assets are more than your current liabilities. |

If your working capital ratio is one, meaning your cash inflows will cover your cash outflows, then that’s good, right? It’s good, but it may not be good enough. Remember from earlier that this formula is an estimate of future cash flows and has weaknesses. That’s why many people recommend having a ratio between 1.2 and 2.0 to give yourself a cash cushion for unexpected cash needs.

If you have consistently strong profits with good access to debt and equity, then you can have a lower working capital ratio. Some companies, like Amazon, have negative working capital ratios. They have massive financial strength and sophisticated cash management processes. Small businesses aren’t Amazon, so keep your working capital ratio above one.

A ratio above two may mean you can invest cash in your business, pay down debt, or distribute it to owners. Run a cash flow projection to confirm this and decide whether you want to keep the cash for safety or invest it for higher profits.

How to improve your net working capital

The key to improving net working capital is to increase short term assets or decrease short term liabilities. I’ll show you effective ways to do this and ineffective strategies to avoid. Let’s start with some effective strategies.

Increasing profits

Profits are not the same as cash flow (see my article on this) but profits usually do eventually increase cash. Becoming more efficient may also reduce your need for equipment or other assets, which reduces your need for borrowed money. That borrowed money may be sitting in your current liabilities, reducing your working capital ratio.

Increasing profits takes time. Don’t do anything that damages the long-term value of your company to juice short-term profit. They only exception to that rule is when you’re so tight on cash that the entire future of your company is questionable. When your company needs immediate cash, you may have other options that I list next.

Increase long-term borrowing

Long-term borrowing increases net working capital by either increasing cash or paying off current liabilities. One of the most common ways businesses get into a cash crunch is by using short-term debt to finance long-term investments. Using credit cards or operating lines of credit to buy equipment is one example.

Owners often enter this cash trap because they want to save costs and are betting on future cash flows. Short-term debt is easier to get than long-term debt and can come with teaser rates as low as 0%. The problem comes from the owner’s bet on future cash flow.

When profits aren’t as high as projected, the owner doesn’t have the cash to pay off the short-term debt. That short-term debt suddenly becomes very expensive due to late fees, penalty interest rates, damage to the company’s credit record, and decreases to the owner’s credit score.

The problem comes from the owner’s bet on future cash flow

One option is to refinance the short-term debt into a longer-term payment plan. This may be the best solution for both the borrower and the lender.

Always match the term of your debt to what it’s purchasing. Use term equipment loans or commercial real estate mortgages to finance equipment and buildings. The cost may look a little higher at the beginning, but it may be much cheaper in the long run. More importantly, long-term debt allows you more time to build earnings and other sources of cash to pay down the debt.

Using short-term debt for equipment or buildings is a big gamble. The better solution is for owners to invest more in the company. You may have to add owners to fund the growth.

Equity investment

Owners make cash commitments to companies that debtors don’t. Cash from owners gives maximum flexibility to the company.

Debt comes with required scheduled payments. Lenders who don’t get paid can involuntarily force a company into bankruptcy. Owners commit cash and aren’t promised when, or even if, they will be repaid. They accept this risk for the rights to the future profits of the business.

You usually must use cash from lenders to purchase the asset that you are pledging for collateral. When you sell the asset, you must pay off the loan. Cash received from owners can be used for any cash needs of the company.

Selling assets

You may have assets that are no longer used that you have kept “just in case you need them in the future.” This could be a much-needed source of cash.

A related strategy is to lease or sublease portions of building that you aren’t using. You may also be able to sell a large building and move into a smaller building that better fits your current size. These are long-term decisions. Only choose them when you are desperate for cash or you don’t think you will need additional space for many years.

Ineffective strategies to improve your working capital formula

Many strategies listed in articles on working capital show how to increase your cash balances. However, they do not improve your net working capital formula or your working capital ratio. These include:

- Collecting or factoring accounts receivable. This increases cash but decreases accounts receivable, so current assets do not change.

- Reducing inventory. Inventory (a current asset) goes down but usually so does accounts payable (a current liability). In other cases, inventory goes down while cash goes up from sales, with little short-term increase in net working capital.

- Short-term debt. Both cash (a current asset) and short-term debt (a current liability) go up. As I mentioned earlier, this can be very dangerous if the cash isn’t available later when the debt is due.

Many tactics above are useful cash management techniques. I list these and many others in my article on how to improve cash flow. However, these strategies won’t improve your net working capital formula or your working capital ratio. This distinction is important if you are trying to borrow money and need to increase your working capital ratio to get the loan.

A banker’s tip: Funding permanent working capital

I’ll leave you with a banking tip that surprises many growing businesses. As I hinted earlier, not all current assets will increase your cash in the next year. This can happen when increased sales drive increases in accounts receivable or inventory. This is called permanent working capital, which I explain in more detail in my article Permanent Working Capital: What Is It and How Does it Trap Cash?

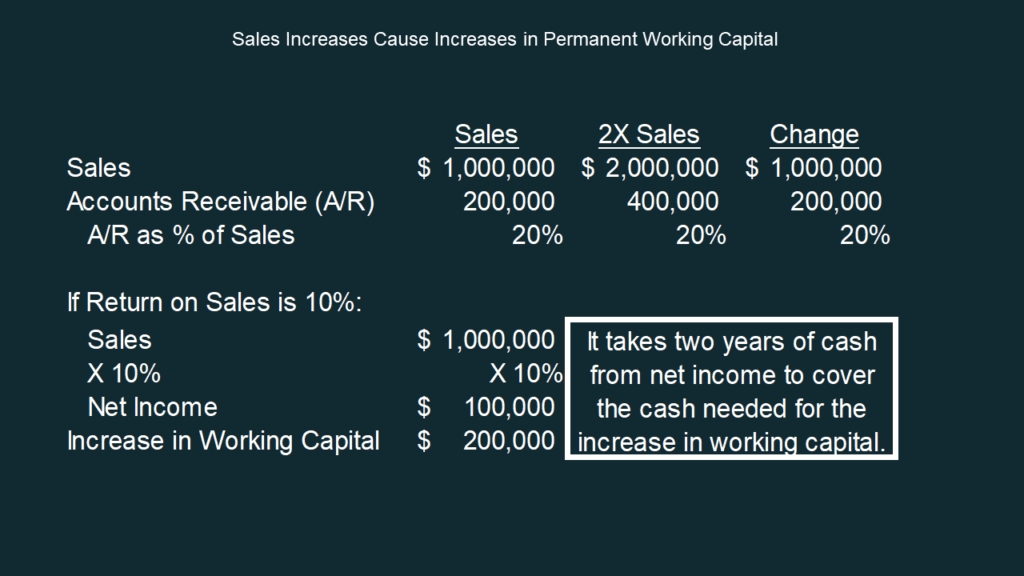

You create accounts receivable when you sell to customers and collect the cash later. Your accounts receivable is a constant percentage of your sales. When your sales go up, your accounts receivable goes up. It won’t decrease until production goes down, which may be very, very far in the future.

In the example above, sales doubled from $1 million to $2 million. Assume that accounts receivable (A/R) is always the same percent of sales. The example company’s A/R is 20% of sales, so the $1 million sales increase leads to a $200,000 increase in current assets.

This means the company’s net working capital also increased by $200,000 from the sales growth. I just focused on A/R, but the sales growth likely also caused inventory balances to go up and accounts payable (i.e., payment due to vendors) to go up. Overall, net working capital usually increases with sales.

Doesn’t an increase in net working capital mean you’ll have better future cash flows? It does when the current assets and liabilities really will be received in cash. This increase in working assets is permanent so it won’t be settled in cash in the next year. The balances just keep being replaced, so the balance is permanent.

A permanent increase in your working capital is like buying any other long-term asset like buildings and equipment. You need to spend the cash you have or get cash from somewhere else to pay for it.

The cash flow problem

Here’s where understating how your financial statements work can help you clearly see the cash flow issue. The accounting formula that’s the foundation for a balance sheet is: assets = liabilities + owner’s equity.

That’s why it’s called a balance sheet. Your assets are balanced by your liabilities plus owner’s equity.

If current assets go up, then the accounting formula tells you that you only have three choices to get your balance sheet to balance again:

- Decease current assets by using your current cash to pay for it.

- Get cash from long-term liabilities like long-term loans.

- Get cash from owners

Why can’t you just use short-term liabilities to pay for this? The short answer is that it’s only a temporary solution because you’ll need to pay back the short-term loan by one of the three methods just mentioned.

The assumption made by many owners is that earnings will pay for the permanent increase in working capital. Notice in the example above, it takes two years of earnings to create enough cash to cover the increase in working capital. A short-term liability that’s due in one year can’t be paid off entirely by cash from earnings that take two years to build.

Earnings in the first year of increased sales may cover part of the permanent increase in working capital. It’s not enough, though. You usually need another source of cash.

This is part of the funding needed for growth than companies don’t anticipate. Increases in permanent working capital need funded with long-term debt or equity. Using your line of credit or credit cards to finance working capital for growth can lead to a cash crunch.

A useful tool to measure your cash flow

The working capital formula and working capital ratio are two tools to measure your cash flow. However, I showed earlier that they have limitations. They shouldn’t be the only tools you use.

My hope is to help you maintain a healthy net working capital formula and working capital ratio to avoid the stress of a cash crunch. Check out my Managing Cash Flow Program to learn how to avoid common cash management mistakes, reduce stressful periods of low cash, and get the cash you need for growth.

For more info, check out these topics pages: