In this article, I’ll talk about how to better estimate expenses that are common to new locations for most businesses. Expenses are unique for each business, so I can’t create an article that covers all the expenses of every business (well, I could, but it would be really, really long and boring). First, you need to gather some information.

Where to Get Information About Expenses

The sources of information for the new location’s expenses are:

- The company’s current locations

- External market data

- Competitor location data

A detailed income statement for one of your current locations lists the expenses you may need to model for the new location. Use it as a starting point for expenses to research for the new location. Use that list of expense categories again as a checklist when finalizing the analysis to make sure you’ve remembered to model all the expenses.

In a medium-to-large company, you’ll likely need to get information from a few people to project all the expense categories. When I modeled new branches in banking, I spent a lot of time talking with facilities staff, marketing staff, and branch administrators. I would have a long list of expense estimates I needed from them. The conversation would sometimes start like this:

Me: “How much do you think we’ll pay for ‘X’ for the new location?”

Them: “I don’t know.”

They really don’t know. We can’t use break-even analysis as we can with revenues to help this conversation. You may need to help guide them to making a guess.

I would usually start by saying, “I understand you don’t know these numbers right now. Neither do I. We need some sort of estimate for the new location analysis. Someone needs to make a guess, and you’re the most qualified person to make that guess.”

Let them know that they can give a rough estimate at the beginning. They can then make a more educated estimate later. That doesn’t mean they need to make the first estimate immediately; let them have a few days to do research if you have time.

In early presentations to decision-makers, you can also note assumptions in the projection that are less certain. They will need further refinement before a final decision is made.

Vendors are another source of information. A commercial broker or architect is a wealth of information on some major costs. You may also need quotes or estimates from vendors for expenses like utilities, janitorial, insurance, and signage costs.

Staffing

Next to the investments in a new building, staffing is usually the biggest cost in the short term. Over the long term, staffing is often the largest expense.

New locations need new staff. What gets tricky is when current employees transfer to the new location. Then you’re hiring new staff for the new location and hiring new staff to replace the transferred staff. In addition, people are promoted, and other people replace their old position. How to model this?

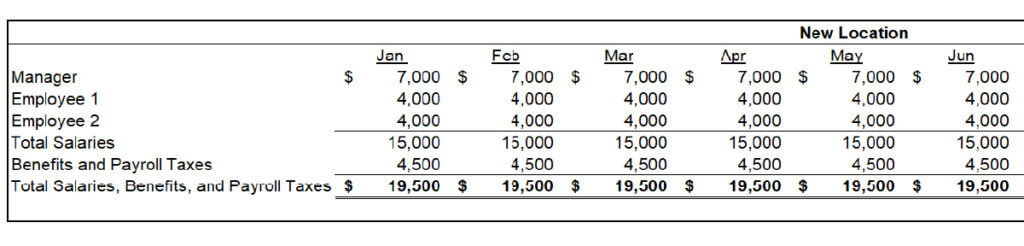

I recommend that your projection lists each position by title for the new location and what they will be paid. This is the starting point for a budget for the location. If there are many employees, you can have a support sheet that lists all of the employees. The total from that sheet is shown in a line titled “Total Wages” on the projected income statement.

This assumes that the new location is a new department, cost center, or profit center. You don’t have to do this for whole departments or centers that are moving to the new location.

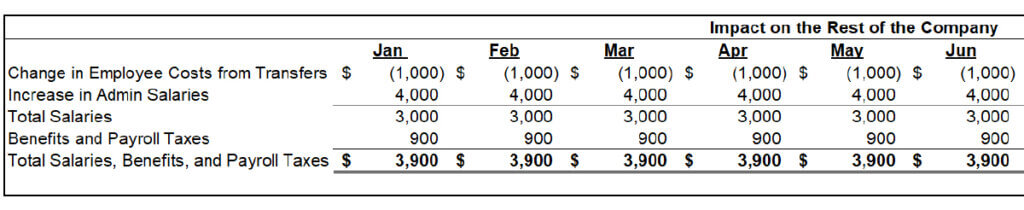

You’ll also want to list changes in wages in other parts of the company caused by the opening of this location. Here are some examples of those changes:

- Difference between the wage of a person that transferred to the new location and the wage of the person who replaced them.

- Additional staff needed to support the new location(s) and staff at the new location(s) (e.g., facilities, HR, IT).

- Any reductions in staff at other locations caused by the move. This sometimes occurs if another location is overstaffed and transfers employees to the new location.

You could list these costs after the net contribution for the location. The wage images above come from the new location projection example I offer in my new location course.

Marketing and Advertising

If you sell anything at the new location, it will be supported by marketing and advertising. There is often a flurry of marketing for new locations.

The marketing push comes with two types of expenses:

- Direct: Advertisements, mailings, search engine advertisements, signage

- Indirect: Promotional pricing of your goods and services

Marketing staff will likely have a marketing plan for the new location and can provide you with estimates of the direct marketing costs.

Sometimes this is a “chicken vs. egg” discussion. You’ll ask them how much they will spend, and they’ll ask you what their budget is for the new location. If this occurs, ask them to make a plan for a reasonable promotion for the new location as a starting number. Once again, the analysis is iterative. If their initial budget is too high or low, it can be adjusted in later versions.

Promotional pricing will cause reduced revenue per unit but a higher number of units in your revenue projection. For example, you may estimate that you could sell 1,000 units of a product at $100 per unit in the first three months at the new location. If you run a grand opening sale that cuts the price to $75, you may then estimate you would sell 1,100 units.

You want to model the initial impact of the promotion as well as the ongoing costs and benefits of the promotion. Many of these promotions are loss-leader promotions where you’ll lose money on the promotional items during the promotion period, but you’ll gain additional foot traffic in future months.

In my article on projecting revenue for a new location, I talked about sales cannibalization. You may have very high cannibalization during these promotional periods. Existing customers will go to the new location both out of curiosity and to get great deals.

Promotions may also cause price cannibalization at existing locations. This happens when a promotional price is offered not only at the new location but also at existing locations. Regular customers of the existing locations will get a lower price for items they would have normally paid the standard price for. The drop in profits at current locations should be added to the bottom of the analysis of the new projection.

Inventory

The correct inventory levels can be very difficult to set in the early days of the new location. This is where having sales data from the opening of your other locations will greatly help you estimate proper levels. For modeling purposes, your inventory costs will be driven by your revenue projections.

Stock too much inventory, and you tie up cash in inventory while also risking obsolescence. Stock too little, and you miss sales opportunities and disappoint customers.

Your inventory levels will need to be adjusted for the marketing promotions I just talked about. Having new customers visit your store in hopes of a great deal you’re promoting, only to find you’ve sold out of it, is a very expensive mistake.

Equipment, Furniture, and Fixtures

Here are some considerations for equipment and furniture:

- Financial staff may be asked to analyze whether to lease or buy these items. You may choose to lease, even if it’s more expensive, to conserve cash flow in the near term.

- Don’t choose excessively long lives for these assets for financial accounting. If their depreciation lives are too long, you’ll have to take some losses when you replace them.

- You may finance these items instead of using precious cash for them. The financing could come from a bank or from a vendor. You may have a line of credit that’s high enough to pay for some of these. Do not use it for this unless you are absolutely certain you have short-term future cash inflows to pay down your line. A lending maxim is to match the term of a loan to the life of the asset it’s funding.

One-Time Setup Costs

The new location will have many costs that you only incur when you first set up a location. Licenses and permits are examples. Another example I’ve seen forgotten in projections or budget are office and cleaning supplies. There are a few ways to try to identify these:

- Ask the manager of the location or a similar location to think about what’s in each part of the building and what needs to be stocked for the new location. Better yet, slowly walk through an existing location with the manager. A similar exercise is for the manager to think through a normal day, from opening procedures to closing procedures. Thinking about actions vs. objects can help them remember things.

- Look at the P&L of a recently opened new location to see spikes in expenses in the first few months they were open.

- Look at the expense lines of a current location. For each, ask if there are extra expenses or a certain level of stock that the new location will need to open.

Setup Costs for a Second Location or New Market

The hardest new location is your second location. When you move from a single location to two or more locations, you introduce a lot of complexity. Your staff members are no longer in one place, so communication is more complicated. You have to think about courier service between locations and mail. You’ll have new travel costs as staff drive between locations. These can be hard to anticipate and estimate.

As you continue to add locations, you may decide to add expenses. One might be layers of management, like market managers. You may decide to hire building management employees rather than using management services. I was on the board of a company that decided to switch from leasing to buying locations as they added locations.

Adding a new market is like adding a new location, but the greater distance creates more complexity. Your vendors in current markets may not serve the new market, so you’ll need to work with new vendors. Communication is more complex.

One company I know was adding new two new markets. They decided it was time to buy a company jet. Some expenses for new locations can be unique and expensive.

Taxes

I am not a tax expert, and this article does not delve deeply into the tax implications of the new location. Please consult a tax account or CPA for those. However, there are some state and local tax items you’ll need to do.

A new location means you’ll be reporting sales tax for a local area. If you’re moving into a new state or your new location will cause a large increase in sales in a new state, you will need to start filing taxes in the new state. New states also come with additional payroll tax reporting or new agencies to report to.

All this reporting will require you to track revenues and expenses by location. If you only had one location before and didn’t track by location, you will now need to code revenues and expenses by location. This creates a new layer or dimension in your financial reports. This is very useful for location profitability analysis, so you’re not just creating the accounting complexity for taxes.

Other and Unknown Expenses

As I said in the beginning, there are many other expense line items I could cover. I tried to cover common significant ones. You will have expense line items that are unique to your business and industry.

After compiling all these expenses, you check the new location analysis to an existing site’s expenses per the site’s income statement. You talk with all the internal and external experts to arrive at the best projection they can make for each line item.

Even still, you are missing things. I promise you’re missing things. Either you forgot some items, or there are unforeseen items that you’ll learn about later. There will be cost overruns.

I recommend having one last expense line item in your new location projection titled “other expenses,” “unidentified expenses,” or something similar. This is where you’ll make an estimate of what you’ve missed or have not yet identified.

A starting number for this is 10% of the new location’s total expenses (excluding this line item). Bump that percentage up or down based on how certain you are of your estimates in the rest of the projection. You’ll want a number higher than 10% if any of the following is true:

- This is your first new location

- You haven’t added a new location in a long time

- The new location is significantly different than your current locations

I hope this article helps you better estimate the expenses for your next location or better budget for current locations. Check out my course on Analyzing Whether to Add New Locations for more information about opening new locations.

For more info, check out these topics pages: