CVP is a powerful tool for:

- Break-even analysis (i.e., how much you need to sell to make a profit)

- Estimating burn rates (i.e., how much net cash is used each month) for startups

- Calculating profit at varying sales volumes (i.e., sensitivity and scenario analysis)

CVP helps clarify a company’s financial business model. It’s been very useful when I’ve worked with clients. I’ll show you the basics in this article.

The Cost-Volume-Profit (CVP) Formula

Most businesses could be summarized as:

(Variable Revenue – Variable Expenses) – Fixed Expenses = Profit Before Taxes

This is the cost-volume-profit (CVP) formula. It can be further broken down into this formula:

(# Units Sold X Price) – (# Units Sold X Expense) – Fixed Costs = Profit

This CVP formula is based on accrual profit, so it multiplies the variable expense per unit by units sold. Accrual accounting tries to match expenses to related revenues. It’s a useful and worthy exercise but confuses non-accounting people. You pay your bills with cash, not profit. Many small businesses budget only on a cash basis. If you want to run CVP on a cash basis, use units produced instead of units sold when calculating variable costs.

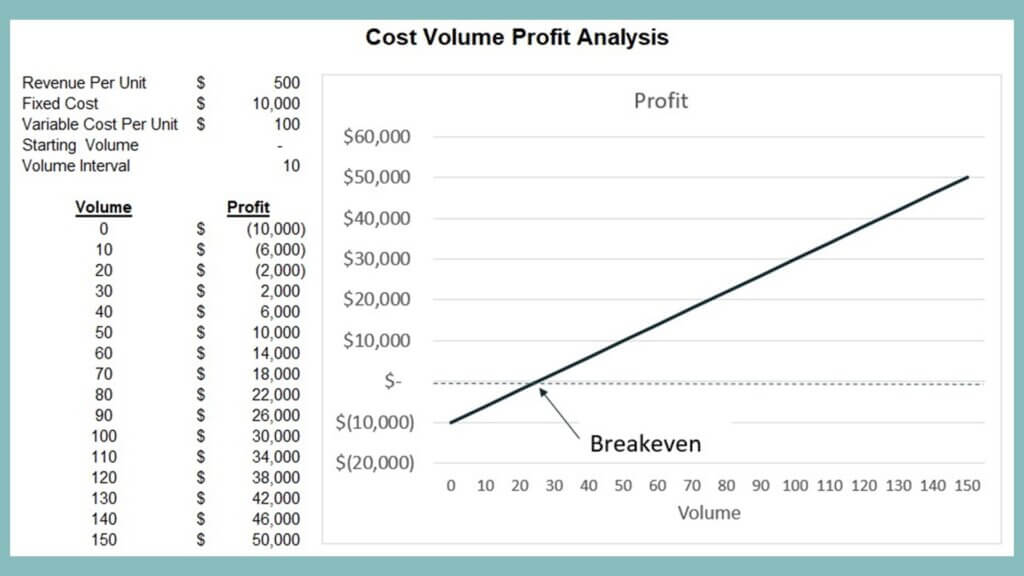

The image below shows a cost-volume-profit graph. Fixed costs are $10,000. Each unit brings in $500 of revenue and costs $100, so each unit contributes $400 toward offsetting the fixed costs. At 25 units, the contribution from selling units equals fixed costs, so profit=0. This is the break-even point.

You may be tempted to think that the CVP formula is the same as a simplified income statement: Sales – Cost of Goods – Other Expenses = Profit Before Taxes. It’s not.

The income statement is grouped by production costs and non-production costs. CVP analysis groups costs by whether they vary with production or don’t. Production overhead is applied to the cost of goods in the income statement but goes into fixed expenses for CVP analysis. Advertising expenses, especially search engine advertising, may be an expense that varies with revenue but would go into other expenses in an income statement. The most important categorization of expenses for modeling is variable, step fixed, or fixed; for many financial reports, it’s direct, indirect, or overhead.

Two uses for CVP analysis are when deciding whether to open a new location and when budgeting. A little analysis could prevent a very expensive mistake. You can quickly find out when a new investment will add to your profit. Check out my Analyzing New Locations course or Better Budgeting course to learn more about how you can CVP analysis in your company.

For more info, check out these topics pages: