Many borrowers pay little attention to prepayment penalties when they get a loan. A few years later, they want to pay off the loan and are shocked at the size of the penalty. You should take steps to eliminate or lower the prepayment penalty if there is any chance that you’ll prepay a business loan.

I’ll explain the two main types of penalties and a way that the penalty can be triggered without paying off the loan.

Step-Down, Declining, or Graduated Penalties

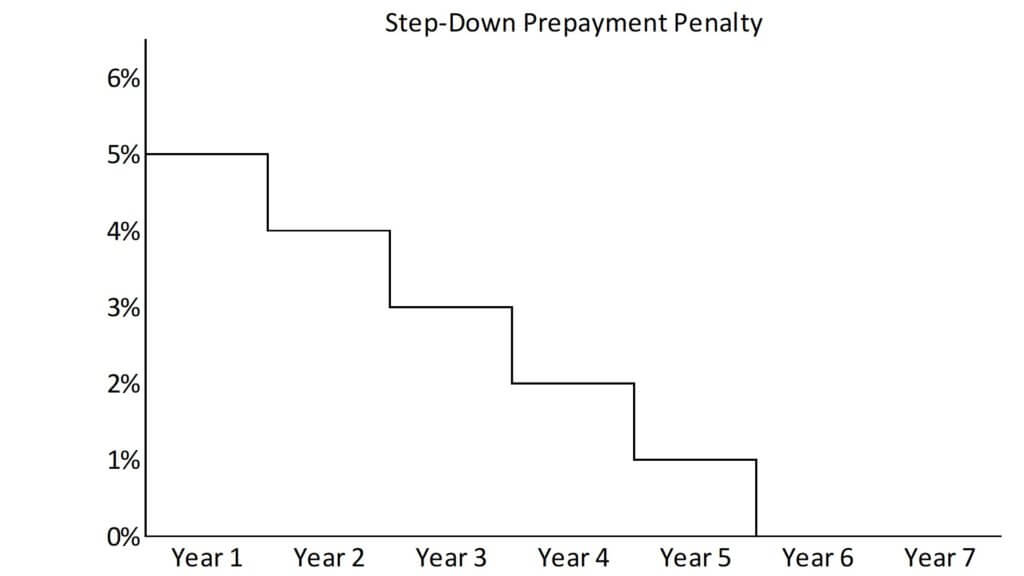

It’s rare for a prepayment fee to be a flat dollar amount or percent over the whole life of the loan. What’s more common for business loans is a declining prepayment penalty stated as a percent of the loan’s principal balance. These are called step-down, declining, or graduated penalties. They all describe the same type of prepayment fee.

For example, if the loan is prepaid in the first year, you would pay 3% of the loan balance, if it’s the second year, you pay 2%, and if prepaid in the third year, then you only pay 1%. With that structure, you won’t pay a prepayment fee after that.

Another example is one that starts at 5% the first year and goes down one percent per year over five years. In year six and beyond, you don’t pay a prepayment penalty. Here’s what that looks like graphically:

“Make whole” or “yield maintenance” Penalties

“Make whole” or “yield maintenance” prepayment penalties are much trickier.

They are calculated as the net present value of: The interest the lender would have earned on the remaining life of the loan MINUS what they would earn based on current loan rates.

In other words, the penalty is how much in today’s dollars the bank would lose if you paid off your loan.

Assume you pay off a 7% loan, and the bank replaces it with a 5% loan. They would earn a lot less interest over the remaining life of your loan.

These penalties go up as current interest rates go down. You would want to refinance a loan if rates went down. The penalty may prevent you from doing this.

The amount of these penalties is a complex calculation. The borrower needs to ask the lender what the fee would be if they prepaid the loan.

These penalties are usually included in loan agreements for long-term fixed-rate loans. They are more common with national or regional banks. These banks are usually big enough to handle the sophistication of these penalties.

Large banks also make loans more frequently that are big enough to place an interest rate swap for the fixed-rate loan. Banks’ funding sources are usually variable-rate, so banks use interest rate swaps to swap the fixed-rate payments from the loan into variable-rate payments. This reduces the bank’s interest rate risk. Banks might be less willing to waive these penalties if they placed a swap because they incur a similar fee to cancel or unwind the swap.

Banks have a strong economic incentive to use these penalties. A “make whole” or “yield maintenance” penalty reflects the prepayment risk the lender assumes with a loan. Banks may want these penalties even if the loan interest wasn’t swapped.

What Triggers a Prepayment Penalty?

The most obvious way to trigger a prepayment penalty is to pay off a loan. However, you don’t have to fully repay a loan to trigger a prepayment penalty. The agreement may say that a repayment of 20% of the original balance may trigger a prepayment penalty for the portion of the principal being repaid.

Avoiding Prepayment Penalties

Here’s a tip for avoiding a prepayment penalty if you are refinancing a loan with one. See if the lender will waive it if you refinance with them rather than getting a loan somewhere else.

Another way to avoid a prepayment penalty is to get a variable-rate loan. This could be a loan that reprices annually or every few years. Prepaid penalties are more common for fixed-rate loans, especially if the lender placed a swap on the loan. The lender may be willing not to charge a penalty or reduce it if you have a variable-rate loan.

An Ounce of Prevention Can Save You a Pound of Penalties

Prepayment penalties can also be called prepayment fees. It’s a semantic difference, but behavioral finance has shown that people are much more willing to pay a fee than a penalty. “Penalty” sounds like you are doing something bad, while a “fee” is the price you pay to get something you value. Think of these as fees; you are not a bad person for paying them if you need to.

If you have a penalty, you may still save a huge amount of money by paying it. Maybe you can sell the asset funded by the loan at a huge gain. Maybe you can refinance the loan at a much lower interest rate. Businesses usually prepay a loan if current rates are significantly lower than their old rate. You can calculate if the cost savings of a lower rate would offset the prepayment fee of the current loan and any origination penalties of a new loan.

Every part of a loan is subject to negotiation. Your job is to negotiate the best mix of the term, interest rate, origination fee, and prepayment penalty. This mix is based on how long you will have the loan and how frequently you want your rate to change. Don’t forget to consider the cost of potential prepayment penalties when you get a loan.

Check out my Business Loans Basics course for insider tips and ideas for getting the best business loan.

For more info, check out these topics pages: