In lending, the word “term” refers to a period of time. Commercial real estate (CRE) loans often have three types of loan terms: a repricing term, a balloon term, and an amortization term. You can remember these as the “bump, set, spike” of commercial loans:

- Bump – Repricing Term – This is how often your rate bumps up or down.

- Set – Amortization Term – This term sets the amount of your payments

- Spike – Balloon Term – At the end of the balloon term, the amount due spikes up to the full loan balance.

I’ll explain each term and the choices you may want to make to match your cash flows and maximize your profit.

Repricing Term

The repricing term is how frequently your loan rate changes.

For floating-rate loans, the interest rate changes whenever the index rate changes. When I worked at banks, we went into a mad scramble whenever the Fed changed the Fed funds rate because it caused the prime rate to change. We had to update our systems that day to make sure customers were charged the correct floating rate.

At the other end of the spectrum are fixed-rate loans. They don’t have a repricing term. Your rate never changes for the life of the loan.

Variable-rate loans lie between floating-rate loans, whose rate can change any day, and fixed-rate loans, whose rate never changes. The rate on a variable-rate loan can change once a month, quarter, year, or every few years based on the loan agreement.

Balloon Term

The balloon term is when the remaining principal is due. You may understand this better if I explain it with an example.

Let’s assume you have a loan with a 10-year balloon term. You would make periodic principal and interest (P&I) payments for ten years. The monthly principal portions of your loan payments are reducing your principal balance over time. At the end of the 10th year of your loan, the whole amount of any unpaid interest is due. It might be a large amount.

You may be wondering why the loan wouldn’t be set to be gradually paid down to $0 by the end of the 10th year. That’s because many business loans have amortization terms that are longer than their balloon terms. I will explain that next.

Amortization Term

The amortization term is the length of time it would take to pay the loan to zero at your loan payment.

Let’s go back to our loan with a 10-year balloon term. If it has a 25-year amortization term, it will take 25 years to pay the principal down to zero. At the 10-year point, when the balloon term ends, you still have a good chunk of unpaid principal balance. I’ll explain this below with a picture.

Example of the Three Commerical Real Estate Loan Terms

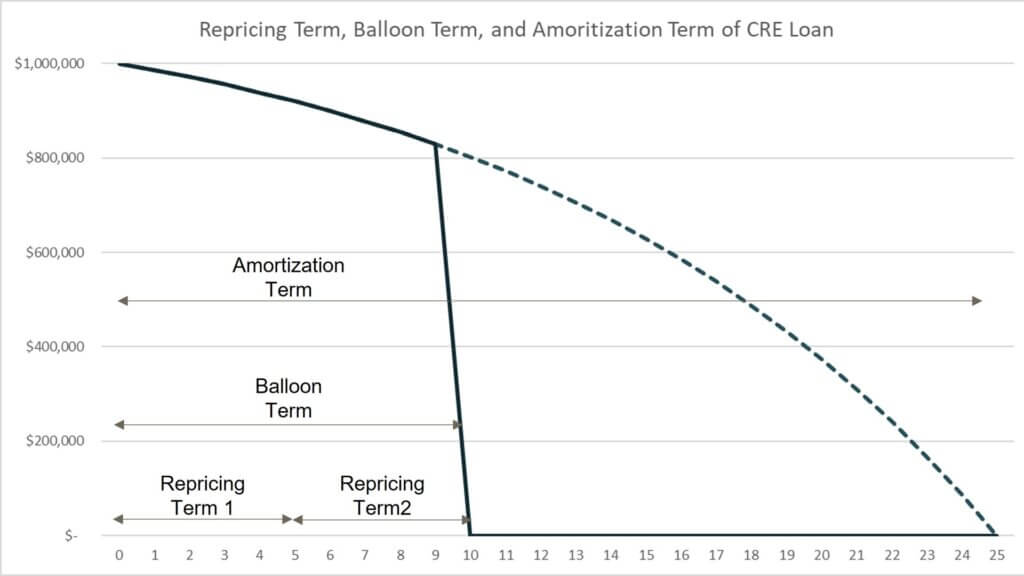

Commercial real estate loans often have a different repricing term, balloon term, and amortization term. The graph below was a common structure of commercial real estate loan terms at banks I worked at. That structure is a set of two five-year repricing terms, with a 10-year balloon term, and a 25-year amortization term. You may hear lenders talk about a “25-year am” which means a 25-year amortization term.

The solid line in the graph is the principal balance of the loan. The dotted line is what the principal balance would have been if the balloon payment wasn’t due at the end of the 10th year. Look down at the bottom left quadrant of the graph. The bottom two sets of arrows show the two 5-year repricing terms. All the principal is due in the 10th year, which is why the principal balance (the solid line) goes from over $800,000 to zero at year 10.

Notice that the balloon term is 40% of the amortization term (if calculated as 10 years divided by 25 years). However, the principal balance is paid down less than 20% during those ten years. The principal reduction of amortizing loans starts slowly and then increases during the term. You can see this in the arc of the solid line leading to the dotted line of the amortization term. The payment amount is set so that your last payment at year 25 would pay the principal balance to zero. That would be the case if your loan rate didn’t change and you didn’t have a balloon term.

Leave it to bankers to make a loan that’s this complicated. Why do bankers do this? The answer is… to give business customers what they want. As a recovering banker, let me try to explain.

The longer the repricing term, the higher the interest rate. Market rates, like Treasury rates, usually increase with longer terms due to the higher risk and uncertainty. There’s the risk that inflation will be higher in the future or rates will increase for some other reason. The price of sources of funding for a bank increase with longer terms, so the price they charge to borrowers increases with longer terms. So, borrowers often choose 5-year or even 3-year repricing terms to reduce their interest rate and interest expense.

That explains why repricing terms are a few years, but why is the balloon term shorter than the amortization term? The shorter the balloon term, the lower the interest rate. The cash comes back sooner to the bank, which reduces risk and discount rates, so banks can pass those savings on to the borrower.

Another way bank profitability improves with balloon terms is because larger loans are cheaper for banks to service. Efficiency increases with loan size. Loans near the end of their amortization terms are small. A bank servicing many small loans would have to pass along the costs to borrowers via higher interest rates.

Why is the amortization period so long? Why is it longer than the balloon term? The longer the amortization term, the lower the total loan payment each month. The monthly payment for a $1 million loan at 7% interest with a 25-year amortization is $7,067. Shorten the amortization term to 10 years, and the payment goes up to $11,611, an increase of $4,544 or 64%. Businesses usually take out loans because cash is tight or because they need the cash for other purposes. These businesses want longer amortization periods to reduce the monthly cash burden of the loan payments.

An amortization term that’s longer than your balloon term does create an event for which you need to prepare: the big balloon payment at the end of year 10. Businesses generally do one of two things:

- If they have lots of cash at the end of the balloon term, they may pay off the loan and be done.

- Many businesses take out a new loan at the balloon term. This loan may be larger than their original loan because the value of the collateral real estate has gone up.

Matching Term to Need

You should match the term of your loans to your cash flows. Let’s imagine you borrowed from a short-term line of credit or credit card for equipment or real estate. You will need to pay back those loans long before the asset has had time to earn enough cash for you to pay back the loan. This would cause a cash crunch, also called a liquidity crisis.

Use short-term financing for short-term needs, like inventory purchases. Use longer-term financing for equipment and real estate.

However, even current assets may give rise to long-term financing needs. One example is permanent working capital. Working capital is the difference between your current assets and your current liabilities. Permanent working capital increases when receivables rise. It won’t go back down until sales go down, which may be very, very far in the future. Your receivables are consistently some portion of your sales. When your sales increase, your receivables increase, and they won’t decrease until your sales decrease. This is part of the funding needed for growth that companies don’t anticipate. Increases in permanent working capital need to be funded with long-term debt or equity.

Putting Together the Right Set of Loan Terms for You

You can adjust each of these three commercial real estate loan terms to match your cash flows and maximize your profit:

Repricing Term

You may want a longer repricing term if rates are low. You may even want a fixed-rate loan to have no exposure to rising rates. You might choose shorter repricing periods if you expect rates to go down or if your cash flows rise and fall with interest rates. Shorter repricing terms tend to have lower rates than longer repricing terms.

Balloon Term

A long balloon term gives you more time to build up cash to pay off the loan or refinance the balance. A shorter balloon term might lower your interest rate.

Amortization Term

Shorter amortization terms usually mean higher payment amounts but lower interest rates. Longer amortization terms reduce your monthly loan payment.

Check out my Business Loan Basics course for insider tips and ideas for getting the best business loan.

For more info, check out these topics pages: