The premise of competition-driven pricing is that prices are set by “the market” or your competitors. It seems so simple, obvious, and grounded in hard reality. Many people claim this is obviously the correct way to set prices.

However, it was quickly dismissed by almost all the sources I researched for this course, even by authors with a very sales-oriented background.

A study titled Competitor-Oriented Objectives: Myth of Market Share “found that competitor-oriented objectives reduced profitability.” They also said, “Competitor-oriented objectives are harmful, especially when managers receive information about competitors’ market shares.”

The competition driving this pricing strategy may not actually be a company’s competitor’s pricing. It may be the company’s own company’s competitive drive for winning deals and higher market share.

It’s a balance. A company can’t ignore competitors, but neither should competitors determine the goals and strategies of a company. A bias toward competition-based pricing can drive a company toward the latter.

Pricing Strategy and Competition-Driven Pricing

A competition-driven pricing mindset assumes that setting prices a little above the competition will greatly reduce sales. Conversely, pricing a little under the competition will greatly increase sales.

There are times when this is true. One example is pure commodity markets. These are markets where all the products are the same, and prices are transparent and quickly updated. Very few products meet this definition. When I worked at an ag bank, farmers would sell their grain into commodity markets like this. On the other hand, wine-grape growers have found a way to differentiate their products and sell them directly to wineries at varying prices.

If you truly believe you’re in a market like pure-competition pricing assumes, your best hope for profits is to fire your sales and marketing staff, end all advertising, and focus on slashing production costs. Price is your only tool for driving sales. When prices drop, your only hope for survival is having the lowest production costs in the market. This is why I find it shocking when sales staff contend that pricing must be primarily competition-based.

Every product has the potential to be unique and offer unique value to a segment of customers. Setting prices solely based on competition completely ignores this opportunity. Some have gone so far as to say that differentiation is a major source of long-term competitive advantage.

Roles for Considering Competitor Prices

Competition-based pricing can be seen as an easy way to set prices when you don’t want to do the work involved with cost-plus pricing or value-based pricing. Taking advantage of this simplicity robs a company of the insights that can be obtained from knowing a product’s costs and the value it provides to customers.

On the other hand, market prices might provide some sort of reality check if you highly doubt the results from cost-plus pricing or value-based pricing.

Price-taking in pure competition-driven pricing is usually as dangerous as completely ignoring market prices. Even value-based pricing begins with a reference price (i.e., the price of a competitor’s product) and then adjusts for differentiation value. However, it doesn’t stop there. The exploration and estimation of value determines your pricing strategy and tactics.

Pricing below the market to drive sales is done with penetration pricing strategies to break into new markets. However, those entrants must have analysis to show that longer-term pricing will provide acceptable margins. Those profits come from pricing for value, low production costs, or both.

A focus on price as the only tool for gaining sales assumes that lowering prices to increase sales is usually a good thing. The leap of faith is that higher sales and market share lead to higher profits. You have no idea if this might be true unless you have calculated your costs and calculated your breakeven points or estimated profits.

Raising prices, even at the loss of sales and market share, may be highly beneficial for profits. This is especially true for products sold to customers that have a low price response (i.e., high prices don’t greatly decrease the number of units purchased by all customers).

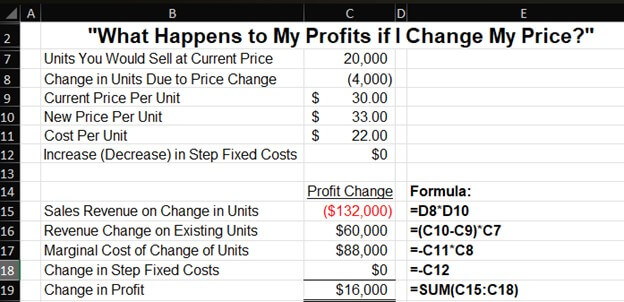

Let’s assume a company is currently selling 20,000 units of a product at $30. They decided to raise prices by 10%, or $3. When they did, unit sales dropped 20% (i.e., 4,000 units). If the total market was 100,000 units, they went from 20% to 16% of the market. Revenue dropped 12%. Many would point to these statistics as a total disaster.

The ultimate goal is profits, not revenue or market share. To calculate marginal contribution or profit, you need to know your costs. Profits increased by $16,000. This is a 10% increase in profits, assuming no fixed costs.

Competitor prices are an important starting point for pricing but not the end or goal. A company must model its costs and customer responses to price changes to get an accurate picture of profit. Profit must also be measured over the long term. Short-term price decreases of a product may lead to profitable cross-sales in the present or high-margin sales in the future.

Summary of the Pros and Cons of Competition-Based Pricing

Here’s a quick summary of the pros of competition-based pricing:

Market Sensitivity

Competition-based pricing allows a company to stay in tune with the market and respond quickly to changes in competitors’ pricing strategies. This flexibility can be crucial in dynamic markets.

Customer Perception

Setting prices in line with competitors can help create a perception of fairness among customers. This can be important in industries where consumers actively compare prices before making a purchase.

Easier Implementation

Implementing competition-based pricing is relatively straightforward. A company can gather information on competitors’ prices and adjust its own pricing accordingly. This simplicity also comes at a cost, which I described earlier and is inherent in the cons I’ll cover later.

Market Stability

By aligning prices with competitors, a company can contribute to market stability, preventing price wars that could be detrimental to all businesses in the industry.

And now for some cons of competition-based pricing:

Profitability Challenges

Relying solely on competition-based pricing may lead to inadequate consideration of a company’s cost structure and profit margins. This can result in pricing that does not support the business’s financial objectives.

Lack of Differentiation

If all competitors in a market adopt a competition-based pricing strategy, it can lead to a lack of price differentiation, making it difficult for any one company to stand out based on pricing alone.

Limited Strategic Control

This pricing strategy puts the company’s pricing decisions in the hands of competitors. It may hinder a company’s ability to differentiate itself through innovative pricing models or to establish itself as a premium or value brand.

Price Wars

While competition-based pricing can contribute to market stability, it may also lead to price wars if companies continually undercut each other to gain a competitive edge. This can erode profit margins for all businesses involved.

Market Myopia

Focusing solely on competitors’ prices might lead to a myopic view of the market. Companies may overlook other factors, such as product quality, customer service, or unique selling propositions, that could be leveraged for competitive advantage.

For more info, check out these topics pages: