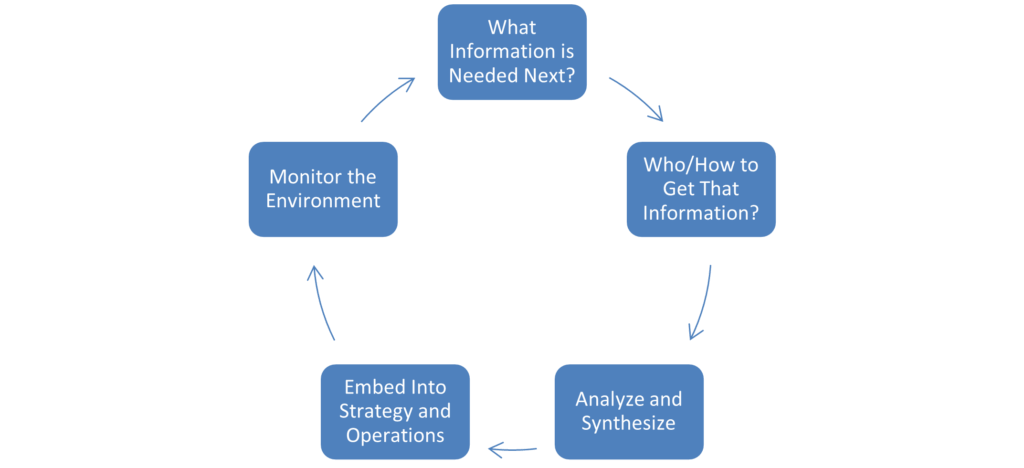

Environmental monitoring is continuous. However, there are times when it should drive action. We’ll look at the monitoring cycle that does this.

Overview of the Cycle

The environmental monitoring cycle can be broken into five steps:

Almost by definition, there is no starting point in a cycle. For this lesson, I’m assuming that a company is starting its strategic planning process. This often begins with a flurry of gathering and analyzing the data that will inform the anticipated big decisions of the strategic planning meetings. The best place to start, then, is the top of the cycle. Here’s an overview of the steps.

- What information is needed next? This question defines the criteria for what data will be focused on out of the mountains of available data. Company leaders usually decide this question.

- Who/How to get that data? The image perfectly shows how tasks roll downhill. Top leaders ask their direct reports to get the data, who then ask their employees. And so the cycle goes until the request reaches someone who accepts that they are the best person to gather and/or analyze the requested data.

- Analyze and synthesize – Raw data is rarely insightful or actionable. Someone needs to analyze it for its implications. The data and its implications must be clearly and succinctly communicated to decision-makers.

- Embed into strategy and operations – This is the magical moment where thoughts become actions. Decision makers decide what should be done in light of the information and take steps to make that happen. Actually, they don’t take those steps. A series of tasks roll downhill again until someone accepts they are the ones to make it happen.

- Monitor the environment – This step is what makes it a cycle. A company’s employees should constantly monitor the business environment to identify information that needs to be acted upon by someone in the company. Triggering a cycle shouldn’t wait until a formal strategic planning process. Each significant piece of information can trigger a cycle.

Let’s look more closely at each step.

What Information Does the Company Need Next for Planning?

This question is often first answered by one of three other questions:

- What decisions need to be made?

- What information has been requested for past planning?

- What recent and significant information needs to be included in the next planning session?

Here’s a little more about each of those three questions:

1. What decisions need to be made?

This may be the best question to start with. It gets to the heart of the situation and is the most likely question to lead to action. Much wasted effort can be avoided by clarifying a decision before deciding what information is needed for a decision-making meeting.

2. What information has been requested for past planning?

Some leaders have reports they like to see or at least have access to for each planning round. I like to call these reports “security blanket reports.”

Rather than mindlessly creating these reports, ask, “How might this report be useful for planning?” If it doesn’t have a compelling use, it may be time to not produce it again. You may discover that only one piece of the report is truly useful, and all other parts don’t need to be prepared.

3. What recent and significant information needs to be included in the next planning session?

Any area of a company may have some recent information that needs to be quickly escalated. It must be absolutely compelling to be fast-tracked into the scarce time available from busy company leaders. Information that’s not as time-critical may wait for other management meetings, the next planning process, or when this issue becomes more of a priority.

Who Decides What Information Needs to be Gathered?

Company leadership will likely decide questions #1 and #2 above. Each department is likely aware of #2. The answer to #3 will start from lower in the organization and need to be fast-tracked through the levels.

The final decision of what information to use for strategic planning will be made by the group that plans the strategic planning. I couldn’t keep a straight face when I wrote that sentence for two reasons:

- I know “planning to plan” sounds meta and absurd, but an important step in strategic planning is planning the strategic planning process. This includes setting key agenda items for the planning. I explain this more in my strategic planning course.

- There will be last-minute requests for information. The planning group can’t anticipate everything. Anyone who has done analysis knows that they will be asked for information ASAP during the planning meeting by someone in the meeting who needs it.

Who/How to get that information?

The next step of the cycle determines who should get the needed information and how to get that information.

If the request for information comes from the top of the organization, the request likely “rolls down” the org chart to the cheapest labor that can do it.

Information can and should also rise through the organization. I worked at an organization that used a process called “Connections” by the Cardwell Group. Employees met with their supervisors once a month. Each meeting began with a “big picture” topic in which the employee shared some information about the industry, economy, products, etc. that they thought the manager and company should know about. Other companies have different processes for routing information.

The information may need to come from outside experts. A bank I worked at had a commercial real estate expert talk to the board of directors because real estate loans comprised a large percentage of the loan portfolio.

Another option is to build cross-functional teams. They may be formed around identified opportunities or threats to the organization. Having a team look at these items together from multiple perspectives improves the efficiency and effectiveness of analysis and synthesis.

Sources of information are both external and internal. Environmental analysis explores the interaction between a business and its environment. The environment acts on the business, and the business acts on the environment. The next step in the cycle of synthesis is to find the important relationships between internal data and external data.

Some types of data that Finance usually gathers include:

- External data

- Economic data

- Competitor financial data

- Market data

- Industry reports

- Supplier information

- Tax information

- Regulatory information

- Pricing reports

- Internal data

- Company financial data

- Product and customer profitability data

- Key metrics

- Liquidity and cash flow data

- Financial planning for owners

This is not an exhaustive list; the possibilities are endless.

Analyze and Synthesize

As I noted earlier, raw data is rarely insightful or actionable. A piece of data’s relevance to company performance determines its importance.

Analysis and synthesis transform data into useful information. They explain the importance of the information and often suggest decision options.

Synthesis links data to the various ways an environmental factor may impact a company. It thus connects pieces of data to form a broader story of the environment and its impact. Synthesis also summarizes and simplifies, without loss of key information, the nature, impact, and options for an environmental factor. Data points become a story or hypothesis that leaders need to hear.

Financial analysis is part of synthesis. The potential impact of environmental factors is measured via changes to income or key metrics.

Some common financial analyses done by Finance as part of environmental monitoring include:

- Economic assumptions for later projections and budgets

- Assumptions for stress-testing scenarios (e.g., recession)

- Company performance if benchmark levels from competitor analysis are achieved. For example, what would a company’s return on equity be if it achieved the operational efficiency of key competitors?

- Sales and profit projections at varying market shares

- Costs of implementing new regulations

- Costs or savings of tax changes

Here’s an example of synthesis across multiple departments and perspectives in a company. A competitor is expected to come out with a new product. Marketing and sales staff could estimate potential impacts on the company’s sales. Production and R&D staff could estimate the ability and cost to match or exceed the competitor’s product. Finance would then run income statement projections that reflect the range of scenarios given by these departments.

Embed into Strategy and Operations

This is the key step when analysis leads to action. If this isn’t done, all the work done so far is worthless.

One aspect of this is embedding the information and resulting decisions into a company strategy. Business environment analysis is commonly done before or in the early stages of strategic planning. The analysis is the context and drivers of strategic planning discussions. All strategies should flow from the implications of the environment analysis. If they don’t, the plans will likely be implemented in a future reality that doesn’t match the plans’ assumptions and limits their effectiveness.

Another aspect of this step is to embed the information and decisions into financial projections and budgets. Key assumptions from the planning process should be integrated into ongoing financial projections.

I mentioned earlier many of the projections I used to do in banking. These models were very sensitive to economic factors like inflation and interest rates. The balance sheet assumptions in the models were also driven by environmental factors like industry trends and competitor actions. These rate and balance sheet assumptions combined to produce the income statement projections.

Budgets are usually the most consequential forecast developed each year. In some companies, it’s the only financial forecast done. The environmental analysis flows into the budget. It flows directly if no strategic planning process is done after the environmental analysis. It flows indirectly as it is further developed through a strategic planning process. The environmental analysis informs the strategic planning process, which then leads to a budget aligned with that strategic plan.

The environmental analysis sets key assumptions for the budget. These include:

- Sales amounts and mix

- Product prices

- Costs for inventory and admin expenses

- Changes in locations or distribution channels

- Tax rates

What Information Does the Company Need Next for Planning? (Revisited)

And so the cycle continues.

Information can be requested to be produced periodically as part of ongoing monitoring, or it may only be gathered once as part of an ad-hoc analysis.

For ongoing monitoring, company leaders may decide to monitor some information on a periodic basis (i.e., monthly, quarterly, annually, etc.). A process needs to be developed for who will monitor these reports and the frequency they will be reviewed. There must also be procedures for when to elevate information for further analysis or for notification to higher levels of the company.

Ad hoc information is only needed for a specific decision. Examples of these include:

- Major capital investments like new locations

- Changes in pricing strategy

- Changes to distribution channels

- Mergers and acquisitions

- Debt and equity issuance

Monitoring Assumptions

Monitoring is required to identify when assumptions for the strategic plan or budget are no longer accurate. For example, an unanticipated new technology or accelerated inflation will require changes to plans and budgets for them to be relevant to the new reality.

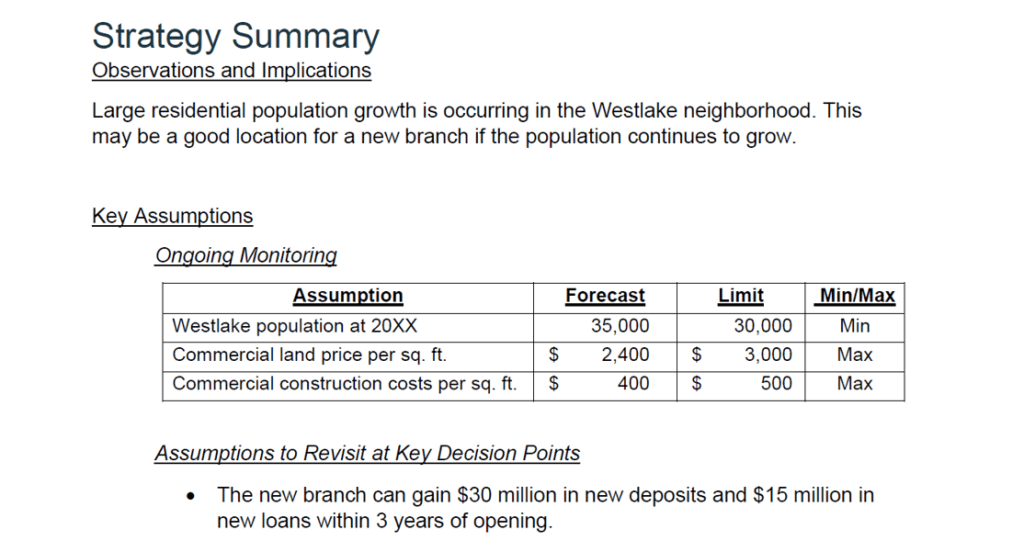

One of the easiest ways to monitor assumptions is for those assumptions to be documented. This is best done during the strategic planning process. A simple example of a way to document strategies, including assumptions, is a strategy summary document. It has the following sections:

- The document starts with the observations and implications of the environmental analysis.

- Next, the key assumptions that underlie any analysis or discussion that led to the decision are listed. Some are listed for periodic monitoring, and others can or should only be revisited at key decision points.

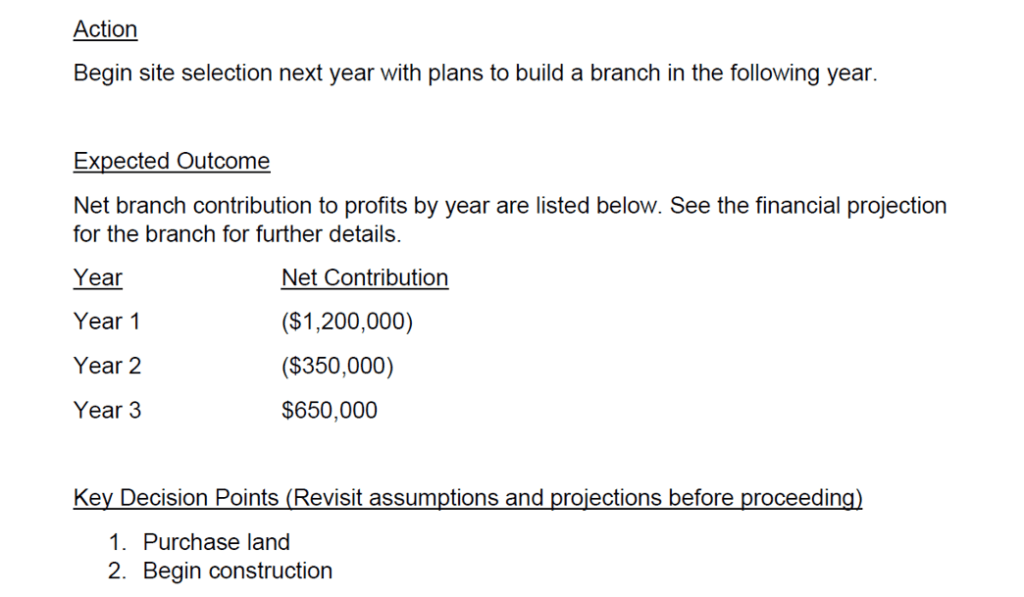

- The action section summarizes the strategy.

- Expected outcomes from the strategy are summarized.

- Finally, key decision moments are listed. These are critical times to revisit assumptions and analysis of the strategy. These often occur before commitments of capital or staff time.

Here’s a sample Strategy Summary:

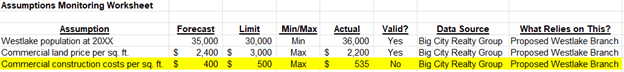

The key assumptions are then compiled into a single document for monitoring. A very few of these may be embedded in a Key Performance Indicators (KPI) dashboard or project plans. The vast majority will need to be periodically monitored against actual rates, amounts, or events. A sample simple way to monitor these assumptions is with an Assumptions Monitoring Worksheet.

The key assumptions from the Strategy Summary document have been carried over to this document. This document also notes where to get the ongoing monitoring information. The example has one assumption that is no longer valid because actual costs have exceeded the assumption. This needs to be communicated to the manager leading the project or strategy.

Continuous Monitoring

Environmental monitoring is most effective when it’s continuous and part of the culture. Early identification of important information allows early action. Being part of the culture means that everyone in the company gathers and passes along information.

One reason to communicate the strategic plan to everyone in the company is to help employees know what information is important. Companies that do a poor job communicating their strategic plan will be flooded with irrelevant information from employees. Companies that don’t communicate their strategic plan won’t receive critical information.

For more info, check out these topics pages: