Not all current assets will increase your cash in the next year. This can happen when increased sales drive increases in accounts receivable or inventory. This is called permanent working capital.

Permanent working capital is the amount of working capital that a company consistently maintains. It’s the net current assets that you’ll never receive in cash until you no longer operate or your operations significantly decrease. The biggest source of this is the timing of your cash conversion cycle.

For a company that sells goods, you will need to buy a large amount of inventory to stock your store or warehouse. You will constantly have that amount of inventory until you close. Also, the longer it takes to collect cash from your customers, the larger your permanent working capital.

Service companies have a similar cycle. They must hire and pay for staff to provide services. In a sense, the “inventory” of a service company is the service delivery capability of the staff. Once those staff are trained, they provide services that are billed to the client or customer. Those customers often have time to pay on the invoice, which creates accounts receivable. The staff are paid long before the cash is collected from the customer. Since both product and service companies have similar dynamics, I’ll use a product company in the example below.

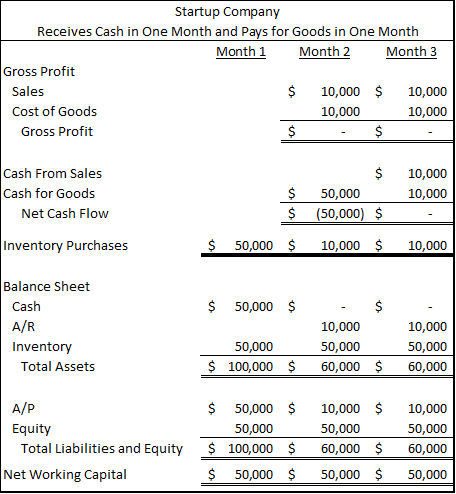

Startup Company Example

In the first example below, the company buys $50,000 of inventory before opening. They have $50,000 of seed capital from the owner. This company pays for goods one month after receiving them, and they also receive cash from customers one month after the sale.

In month 2, they sell $10,000 worth of goods and restock the same amount. For simplicity, I’m showing a company that sells goods and buys goods at the same price. This is obviously not a good strategy in real life. I’m doing this to isolate the changes in cash to only those due to changes in working capital. In real life, a startup company may earn a margin on its sales, but advertising and other overhead costs are likely higher in the early months of the company.

In month 2, they pay for the inventory they bought in month 1. In month 3 and going forward, they are always receiving $10K from customers and paying $10K for inventory, so their net working capital is always $50,000.

The company is solvent because of the $50,000 capital infusion. Imagine if the owners hadn’t put in a capital infusion but instead took out a short-term loan. The company becomes insolvent once the loan is due. What’s more common is that the owner uses credit cards to fund the business. They pay a very high interest rate, which must be somehow funded. Those funding costs, along with the other cash flow pressures of a new company, eventually bleed the company’s cash dry.

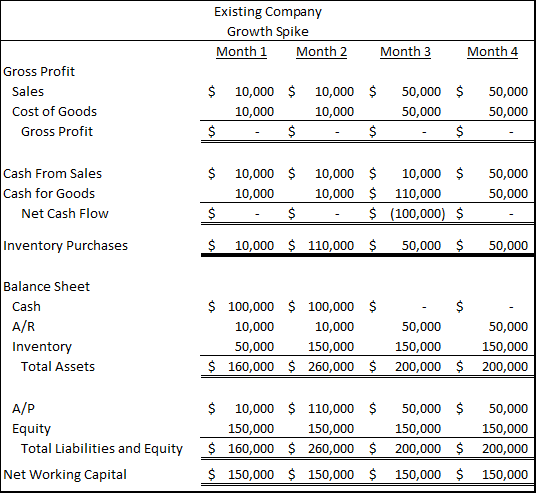

Existing Company Example

Existing companies are subject to the same spike in working capital when they have a spike in growth. Below is the analysis of a growth spike for an existing company.

The company has $10,000 in sales per month and many of the same assumptions as the startup company. Once again, I’m setting sales equal to the cost of goods to isolate cash flow changes to only those due to changes in working capital.

The company has been selling $10,000 for many months. In month two of the analysis, the CEO proclaims that the company is going to “5X sales.” To do this, they need to increase their inventory to $150,000, which is only three times larger than their current inventory.

Once again, this spike in inventory completely depletes the cash. Total assets, which in this simple example are also all current assets and thus gross working capital, spike from $160,000 to $260,000. Gross working capital then levels out at $200,000. Net working capital stays constant at $150,000.

If the company had not started with $100,000, it would have had to get a capital injection from the ownership or some other source of long-term funding. In the real world, they would likely have a positive net margin and potentially a positive net income. This would accrete cash to fund the growth, but this will take months to accumulate.

However, big spikes in growth in the real world also require investments in staff, equipment, and people. These all drive up overhead. Like the startup, this investment will require money and will likely depress earnings before increasing them. This means that before growth occurs, a company must not only fund the increase in gross working capital on the balance sheet. It must also fund the sum of net negative cash flows due to overhead exceeding the increase in gross profit.

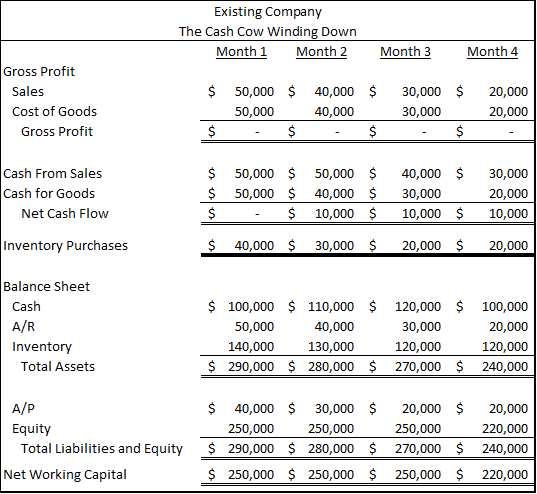

The Cash Cow Winding Down

We see the opposite effect of cash when a company winds down. Companies or products in the late stage of their life are often called “cash cows.” The cash from this cow is milked from stable but declining gross profits. It’s also milked from the release of formerly permanent gross working capital. The example below once again sets gross profit to zero so we can see the cash flows from changes in working capital.

Sales are dropping for this example company. They are allowing inventory levels to drop with sales. This increases cash balances. In month four, the cash accumulated from the wind-down is distributed to the owners. The distribution reduces cash, gross working capital, and net working capital.

When companies have low cash balances and can’t reduce their working capital accounts through efficiency, they sometimes shrink the company to get cash. This mirrors the cash flow dynamics of the cash cow example.

For more info, check out these topics pages: