EBITDA is a metric that’s a simple version of cash from operations. It adjusts earnings by non-cash and non-operations-related items. The definition of EBITDA is:

Earnings

Before

Interest

Taxes

Depreciation

Amortization

Not surprisingly, the formula for EBITDA is:

EBITDA = Earnings + Interest + Taxes + Depreciation + Amortization.

Positive EBITDA means that the core operations of the company are likely producing positive cash flow. It’s your net income with certain expenses added back to those earnings. The expenses added back are non-cash flow items, taxes, and funding costs. The tax expense is the GAAP tax expense, which may be very different than the cash paid in taxes.

EBITDA does not include changes in working capital balance sheet items like accounts receivable or accounts payable. Cash from operations from the statement of cash flows is a more detailed and accurate measure of operational cash flow.

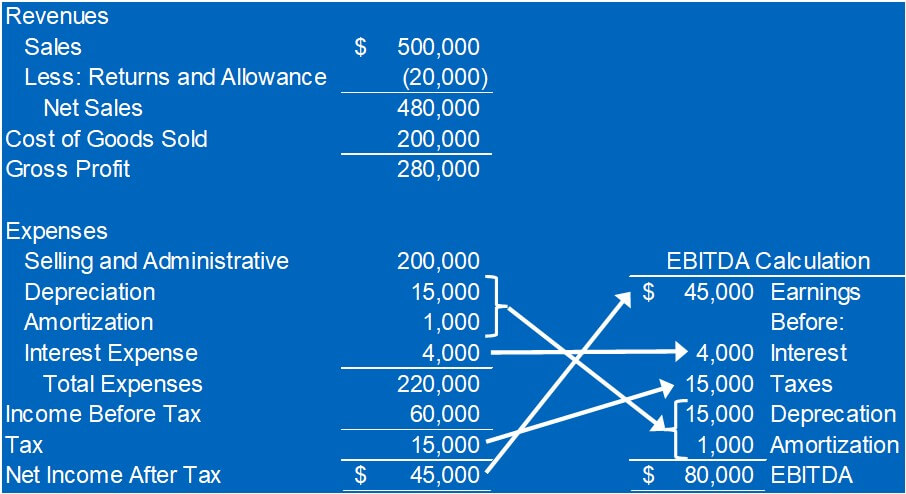

Here’s an example of how to calculate EBITDA.

This is the income statement for a sample company with the calculation of EBITDA in the lower right. You start with earnings, which is the $45,000 of net income. Next, add back a series of expenses. The arrows show where each part of EBITDA comes from in the income statement. The sum of all those is EBITDA.

I cover EBITDA, other cash metrics, and ways to improve your cash in my Managing Cash Flow Program.

When Is EBITDA Used?

EBITDA is a way to measure the cash flow of a company. Investors and analysts use it. Banks use EBITDA to decide whether to make a loan. EBITDA is part of the Debt Service Coverage Ratio banks use to determine if you can repay a loan. This ratio compares your EBITDA to your debt payments.

Want to manage your cash flow better? Check out my Managing Cash Flow course.

For more info, check out these topics pages: