It’s important to understand the different types of costs and when to use each type for different decisions. The mistake I’ve seen repeatedly is people taking one type of cost to make a decision that requires another type of cost. This can lead to the wrong decision.

I’ve also seen a massive effort by companies to calculate one category of costs. After all that effort and work, they realize it can’t help them with the decisions they wanted it to help them make. Was the effort a complete waste? Not always. Sometimes the info can be used as the starting point to determining the correct costs they need.

Here’s an example: Let’s say that I know it costs me $1 per unit on average to make a pen. An opportunity comes up to sell 100,000 pens for $1.25 per pen. Should I take it? Since I’m a smart businessperson who makes decisions based on facts, I look at my average costs and happily grab a $.25 gross profit per pen. Here’s the problem: my past average costs aren’t my costs to produce more pens for this sale. That cost may be higher or lower. In other words, I may be making a big profit or a loss on this. I don’t know the right answer until I analyze the right cost. What cost is that? Read on.

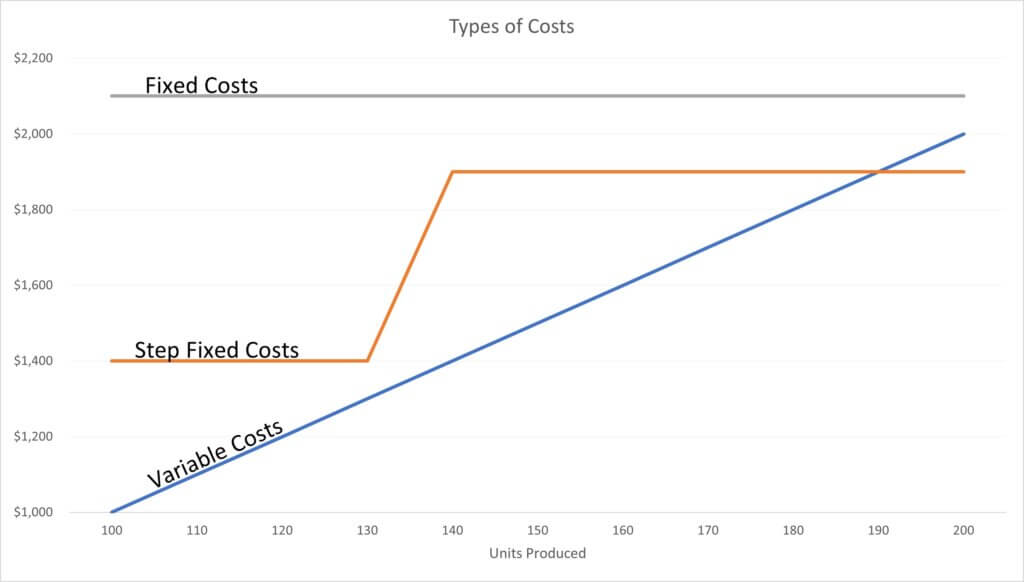

Fixed, step fixed costs, and variable costs

One way to break down costs is into two main types: fixed and variable. Fixed costs don’t go up with volume, while variable costs go up with volume. The cost of website design is an example of a fixed cost. You can make lots of sales through the site, and your website design costs are probably mostly fixed. Your merchant processing costs are an example of variable costs. You must pay a percentage of each sale to your processor.

So far, this is black and white. Now let’s look at a third type: Step fixed costs. These land between purely fixed costs and truly variable costs. For some businesses, these are very common costs. They may be the most important cost to calculate when considering a new opportunity. So, what are they?

A step fixed cost is a cost that stays fixed over a range of production but then shifts to another level of fixed cost when production goes above or below that range.

The most common example is staffing. Most employees are hired on a full-time basis. It’s tough to hire someone for one hour this week and then 50 hours next week, depending on production. You create too much uncertainty for them. You hire them for 40 hours when you can utilize a large portion of that 40 hours. When you don’t have enough business to keep the employee working for nearly 40 hours, you may have to lay them off.

Timing when to hire is tricky. If you hire them before you can keep them busy, you are paying a full-time salary without enough new sales to cover the cost. If you wait to hire them until you are certain you can use their full 40 hours, you stress out your current staff. They are working those hours until you hire the new staff. You may also be hurting customer service and your brand, which comes at a high long-term cost.

Key Things to Know About these types of costs

Fixed costs are often “the price of entry.” If you want to be in a line of business, or in business at all, you have to pay these costs. These are the costs you likely had to incur before starting your business or when deciding to enter a completely new line of business.

Here’s some good news about these costs: Once these costs are incurred, you can leverage them across larger and larger volumes to improve profitability. They determine how much capital you need, which leads to how much you must save or borrow before starting your business. A benefit of high fixed costs is that they create a barrier to entry by new competitors.

A business with high variable costs may have a higher chance of surviving when revenues drop off in a recession. On the other hand, that company may not make as much profit in the good years as competitors with a larger share of fixed costs.

One way to convert fixed costs to variable costs is to outsource rather than own your own production capacity. You lose some control, but you don’t have expensive equipment or staff sitting idle during the slow times. During longer recessions, you don’t have to lay off staff, sell assets at a loss, or sublease commercial real estate.

Step fixed costs are important to assess when you are growing. The key metric to watch for determining when to incur step costs is your amount of excess capacity. You also need to know your lead time when you decide you need to add a step-fixed cost until when you can have them available and productive.

A classic mistake is to hire new staff well past when they are needed. It then takes months to post the job, conduct interviews, hire the person, wait for them to serve the company they are leaving, and then train them in their new job.

Direct Costs, Indirect Costs, and Overhead

Another way to categorize costs is direct costs, indirect costs, and overhead. Direct costs are clearly connected to or caused by producing a product. Indirect costs are strongly tied to production, but it’s difficult to connect them to a single product. Overhead is usually a fixed cost that’s needed to run the company. Examples are executive management, accounting, HR, and brand marketing.

Here are some mistakes I see most often when dealing with these types of costs:

Mistake #1: Using past information for decisions about the future

Companies bring in consultants or build their own product profitability system. It shows the historical average direct costs of the product. They then use these per-unit cost amounts to make decisions about future production or sales amounts. An analogy used for this is “driving by looking in your rearview mirror instead of looking out the windshield.”

The costs to produce more units may be significantly different than the average of all current units. You may need to make expensive step fixed costs to produce more units. You may have excess capacity from past investments in fixed or step-fixed costs. Your future variable costs might be higher or lower. Your past averages may reflect sunk costs.

Mistake #2: Forcing future sales to cover allocated overhead

Another mistake occurs with overhead costs. These costs are split amongst products to arrive at what’s often referred to as the “all-in” cost of the product. The theory is that these costs need to be covered by the products, so you must include them when calculating product costs.

A big problem with overhead allocations is that the logic of allocation methods is tenuous at best and arbitrary at worst. The all-in costs lack credibility. Everyone argues about the allocations, especially managers of products that fare poorly in the analysis.

Worse, companies pass by profitable opportunities. They don’t sell more items when doing so would cover past sunk costs.

What’s the best way to make sales and production decisions? Marginal profitability.

Marginal Costs

Finally, we reach a type of costs that’s the most useful for decision-making. The marginal cost of a product is the cost to produce more of it.

How much more you produce is critical to determining the marginal costs. If it’s just a few items, it may just be the variable cost of goods. If you’re using the excess capacity of existing staff, then their time may be a direct cost but not a variable cost. You’re not paying them extra to produce one more item.

If it’s a larger production increase, then the marginal cost per unit may be much higher. You’re incurring marginal step fixed costs to produce that many items. You may need to hire new staff (potentially direct and indirect/overhead staff) or put in new equipment. Large production increases often lead to additional indirect and overhead costs.

Using Marginal Costs for Production and Sales Decisions

Marginal costs are incredibly important to know because they help you decide whether to take on new opportunities. You should produce something until the marginal costs exceed the marginal revenues.

If I know I can sell $100,000 of something and the actual additional expenses (marginal costs) are only $70,000, then it’s a good move. Of course, you also have to consider cannibalization as a potential “cost.”

If I have to make a big step fixed cost like hiring a new person at $75,000 in addition to the $70,000 costs of goods, now I’m spending $145,000 for $100,000. Bad move.

What if that product is allocated $40,000 of overhead, so the “all-in” cost is $110,000? Will you lose $10,000 with the sale? No. Unless you hit a step fixed cost, your overhead costs aren’t going up. Those allocated costs are sunk costs. Including them in your decision is called the sunk cost fallacy.

Choosing the Right Type of Costs for Your Decision

None of the types of costs I’ve covered are inherently wrong or bad. They all have a purpose. The mistake is matching a type of cost to the wrong decision process.

For more info, check out these topics pages: