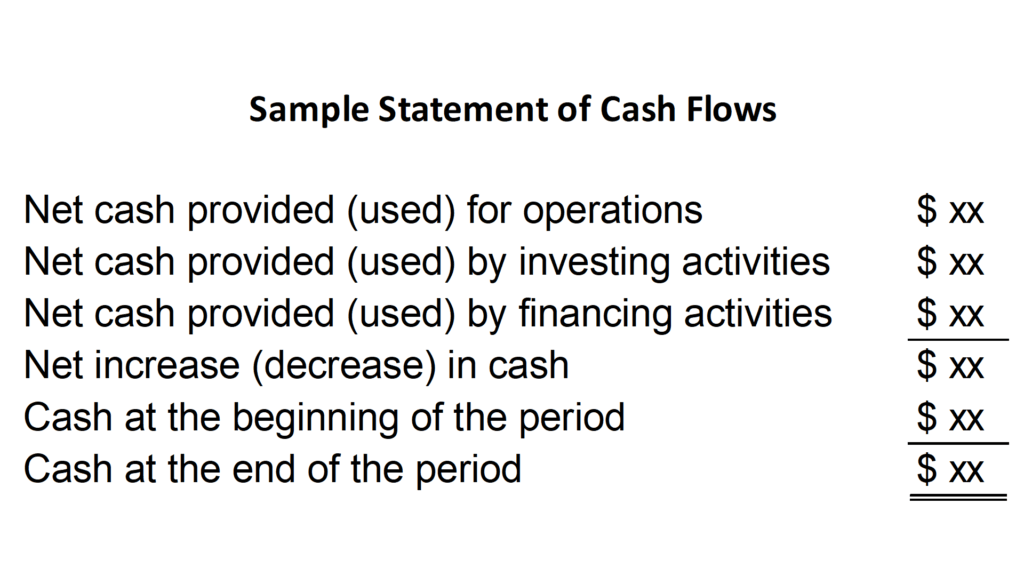

The statement of cash flows is one of the major financial statements, along with your income statement and balance sheet. This statement provides a historical look at where your cash came from and went. Below is a summarized format for the statement of cash flows.

It starts with net cash from operations, followed by net cash from investing and financing activities. You can learn a lot by looking at your net cash from operations. If it’s negative, it means your company’s core business didn’t produce positive cash flow. You can be profitable but bleed cash. The negative cash from operations needs to be covered by your beginning cash balance or by net inflows from investing or financing.

The three cash flow categories in this summarized statement of cash flows format are the same categories I use in cash flow projections.

What Goes Into Each Category on a Statement of Cash Flows Format

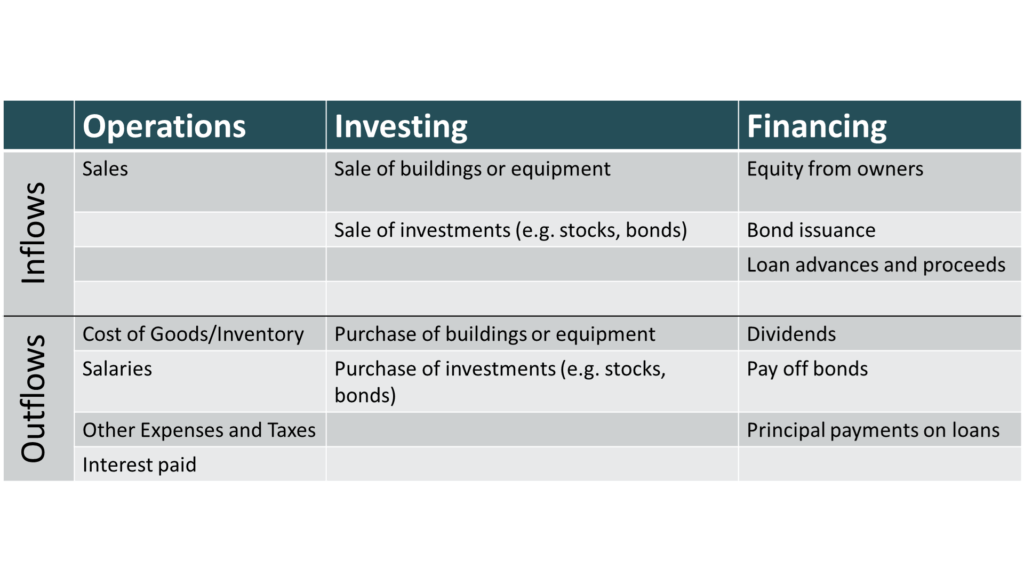

Here’s more detail on what goes into each of the three sections of the statement.

Operational cash inflows are sales. Outflows are most of the expenses on the income statement, also known as the profit and loss statement.

Investing cash flows come from buildings and equipment. Investments like stocks and bonds are also investment cash flows.

Financing cash flows include loans, debt, and equity cash flows.

The statement of cash flows tells you whether your sales produced enough cash to cover your operating expenses. it may show that you need other sources of cash. You can learn a lot about a company’s sources of funds, whether they are investing enough to replace their fixed assets, and how much cash the owners received.

The income statement shows a company’s profitability. The statement of cash flows statement gives you further insights into how your company achieved those profits. You can also learn the warning signals that cash flow is becoming a problem, even if your company is showing profits. Check out my article on cash flow vs. profit to learn more about this.

For more info, check out the Cash Flow Topic page .