A cash flow projection is the most important financial report for your business yet so many businesses miss out on its benefits.

How important is cash flow? Richard Branson said, “Never take your eyes off the cash flow because it’s the lifeblood of business.”

A study by QuickBooks revealed shocking statistics about cash flow issues for small business owners:

- 69% of small business owners have been kept up at night by concerns about cash flow.

- More than half of U.S. businesses have lost $10,000 or more by foregoing a project or sales specifically due to issues created by insufficient cash flow.

- 61% of small businesses regularly struggle with cash flow.

This post will show you how to capture the benefits of a cash flow projection to improve your business. I’ll talk you through how to use a projection. The examples below use a six-month projection. You can get a 12-month projects and many other cash flow tips in my Managing Cash Flow course.

Benefits of a Cash Flow Projection

There are numerous benefits of a cash flow projection. They go well beyond the survival of your company or the ability to have the cash available to capture an opportunity when it arises.

Early identification of potential low (or negative) cash balances

The more time you have to make adjustments, the more options you have to make adjustments. A projection lets you know when you need to speed up cash collection or slow down payments to avoid a cash crunch. For example, there may be times when you have enough cash to quickly pay invoices to capture discounts. Other times you may need to delay payment.

Your bank, investors, or other stakeholders need it

One of your sources for cash may be investors or banks. They will want assurance that your company has enough cash for operations and to pay them back. The very act of having a cash flow projection shows your business management skills and builds credibility with them.

Operations coordination

The timing of when to hire staff, make significant purchases, and distribute cash to owners can all be modeled to make sure your strategy is feasible. You may find that you need to adjust the timing or amounts of some of your strategies. Not having a projection might cause you to make decisions or promises that you can’t fulfill.

Identify cash “leaks”

It’s easy for small things that suck cash out of the business to go unnoticed in daily operations. Reviewing the cash flow projection can show:

- Lags between sales and cash receipt for those sales

- Lags between the purchase of inventory and cash receipt on sales of that inventory

- Opportunities to stretch out one set of payments to prioritize another set of payments.

Stop Your Cash Flow Leaks!

Identify the need to get a loan or a capital infusion

The projection may say that operational cash flows will not be enough to fund opportunities for investment and growth. This means you may need additional cash from lenders or owners.

Avoid tax penalties

It’s not uncommon for bankers to see companies that are making sales but don’t have enough cash to pay the taxes on those sales. Don’t mess with the IRS. Be ready to pay your taxes on time to avoid unnecessary penalties.

Match cash outflows to the seasonality of inflows

Many businesses have a pattern of high cash inflows during certain months of the year and low cash inflows during other parts. At the same time, their expenses may be more evenly spread throughout the year. This causes months where cash exceeds expenses and other months where the cash coming in the door doesn’t cover the expenses. The projection makes sure you have enough cash built up to cover those lean months.

Plan out ownership equity distributions

A good cash flow projection for your company allows you to plan your equity distributions. This helps with your personal financial planning.

Capture Opportunities

Your projection tells you when you will be able to make major investments like equipment. This lets you know when you can start looking for deals on these investments. If you know that good deals often regularly occur during a certain part of the year, you can adjust your cash flows to be ready to capture those deals.

Why Do I Need a Cash Flow Projection If I Have a Budget?

Michael Dell once lamented, “We were always focused on our profit and loss statement. But cash flow was not a regularly discussed topic. It was as if we were driving along, watching only the speedometer, when in fact we were running out of gas.”

You could have profits but still be out of cash.

Some business owners make the mistake of thinking a budget and a cash flow projection tell them the same thing. There are some crucial differences:

Cash inflows and outflows rarely match the timing of revenues and expenses

Cash for inventory or manufacturing staff payroll can be spent well before you record the cost of goods expense at the time of sale. Some businesses collect cash days or weeks after a sale. Comparing your monthly income to your past or projected cash balances is an excellent way to see the differences in timing between the two.

You can be making profits and bleeding cash

Companies fail from a lack of cash, not a lack of income. In fact, companies that are growing quickly are prone to a cash crunch when their cash inflows lag their growing cash outflows.

Budgets are often set once a year while a cash projection should be prepared at least quarterly

The assumptions and strategies underlying a budget are much slower to change than the constant volatility of your cash flows. The timing of cash flows needs to be much more precise than the timing of income in a budget. A business can last a long time without enough income but will die quickly without enough cash.

The Basics of Building a Cash Flow Projection

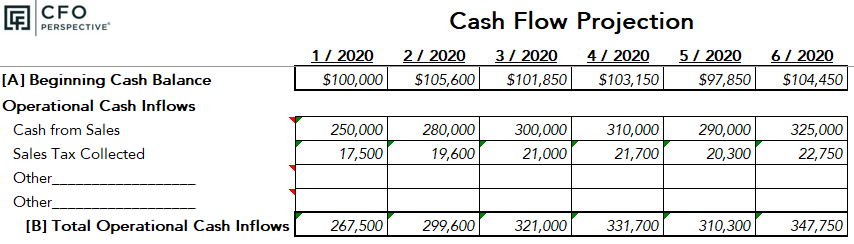

The first line of the projection is your beginning cash balance. You want to check this balance for each time period of the projection to make sure it doesn’t drop below a level you are comfortable with. The sample projection below uses monthly time periods but you can do projections by weeks, months, quarters or years.

The projection then totals your operational cash inflows.

- Cash from sales: The main source of cash flow comes from sales. The top line of a cash flow projection is the cash receipt of sales. The cash receipt for a sale could be weeks before or after the sale based on your business. Don’t just use the revenue numbers from your budget or income statement.

- Sales tax collected: For states with a sales tax, there is a line so you can clearly see what you will need to remit to the government. You always want to have this cash ready for payment when it’s due and not dip into it to finance your company.

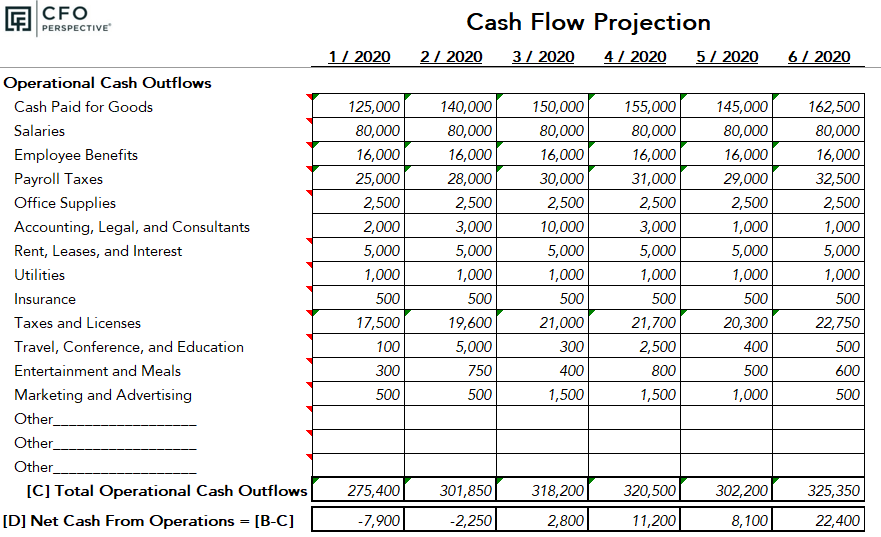

The next major section totals operational cash outflows.

- Cash Paid for Goods: Income statements often begin with sales and then deduct the cost of goods sold to arrive at the gross profit. I grouped the cost of goods with all the other cash outflows. Grouping all the inflows and outflows together is a simpler layout for you to track cash. Once again, put the outflows in the period when you actually pay cash for the goods.

- Salaries: I recommend putting all your salaries on one line. I put it in the first line of operational cash outflows in my cash flow projection. Depending on your industry, you may record salaries in your income statement in two lines (“cost of goods” and “sales, general and administrative”) but you only need one line in a projection. A cash flow projection focuses on when staff is paid, not where to record their salary costs according to the accounting rules.

- Other expenses: The lines after that are your other standard operational expenses like rent, utilities, and marketing. As noted above, put them in the month they are actually paid instead of the month they are expensed according to accounting rules. Do not include any accounting expenses like depreciation or amortization of fixed assets.

The sum of all your operational cash inflows and cash outflows totals your “Net Cash from Operations.” This total is very important. It tells you if your business is producing positive cash flow from your standard operations. You must find supplemental sources of cash for the company if you have negative cash flow from operations. Positive operational cash flow allows you to make large purchases, pay down loans, or distribute cash to the owners. We’ll talk about projecting these next.

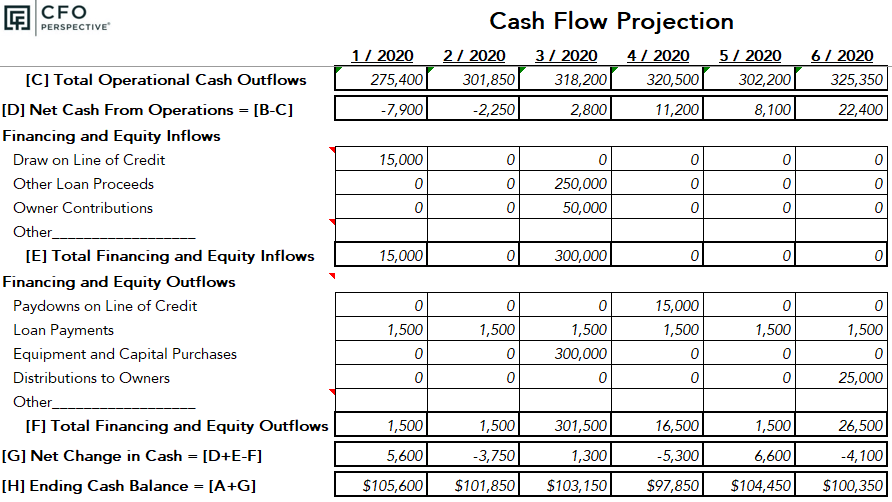

Financing and Equity Cash Flows

Many cash flow projection templates I’ve seen ignore or don’t break out two very important types of cash flows:

- Financing cash flows

- Equity cash flows

You need to understand your operational cash flows before you can start planning your financing and equity cash flows. I recommend first entering the rows for cash from operations sections and any required finance payments in the financing section. You now have critical information to make major financial planning decisions.

Do you have negative operational cash flow or not enough cash for a large investment? This is where you would project how much cash you would need from borrowing money or having the owners invest more equity into the company.

The sooner you can identify potential cash issues, the more options you have to adjust your cash flows to minimize these issues. Check out my post on cash flow management tips for ideas on ways to improve your cash flow.

Do you have a positive net cash flow from operations? Congratulations! You have some exciting options for how to use that cash:

- Invest it back in the business

- Pay down lines of credit or make large principal payments on other loans

- Purchase equipment

- Distribute the cash to owners.

In the sample projection, the owner contributed $50,000 to the company and the company borrowed $250,000 to purchase $300,000 of equipment. This will allow them to continue or even accelerate growth. The company is producing enough cash in the projection by the sixth month for the owner to distribute $25,000 back to themselves.

The sample projection shows how positive cash flow can be invested back into the company for growth to enhance future returns to the owners. The projection helps identify that possibility so you can capture it. In addition to investing for a future return to owners, cash was also distributed now for the personal cash needs of the owner. Cash flow planning for a small business must be done in the context of the personal financial planning of the owners.

The key takeaway is that the power of a projection isn’t tapped if you just enter your best guess of all the items and accept the results. Take the time to think through the possibilities and options. Running multiple scenarios both reduces risk and increases reward.

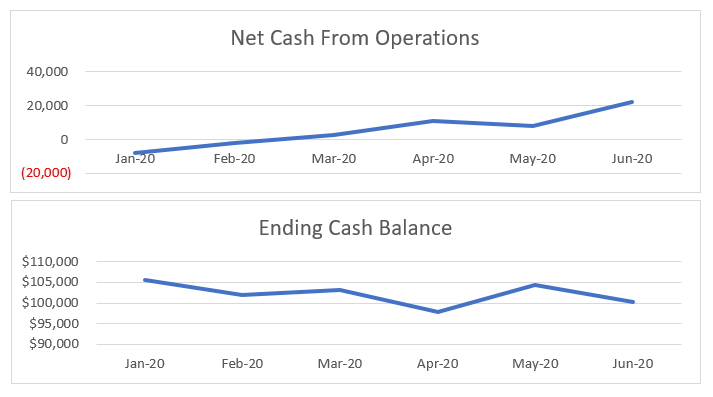

Visualizing the Cash Flow Projection

Graphs help you quickly identify trends, opportunities, and issues. The first two graphs show cash from operations and the ending cash balance.

The sample company in the projection has negative operational cash in January but solid growth in operating cash flow. This could be seasonal cash trends or a much larger trend of growth.

Cash from operations is growing but the company’s cash balances are flat. The company invested $300,000 in equipment for growth and distributed $25,000 to the owner. These are financing and equity cash flows that aren’t included in the operating cash flows of the first graph.

Cash in the bank provides a margin of safety for the company. On the or hand, cash is a very low-yielding asset for your company and can often be invested back into the company for higher future returns. Modeling different combinations of investing or distributing cash allows you to achieve the optimal balance of risk and reward.

Your Best Guess is Better Than Not Guessing

I’ve done hundreds of cash projections in my career. Sometimes I have the information to develop the projection and but many times I needed to ask someone for the amount of a cash inflow or outflow. They would often answer that they didn’t know the amount. It’s true they don’t know the exact amount of cash that will be needed for something but they usually have a good idea.

Remember you’re making a projection so it’s your best guess. You aren’t expected to perfectly predict the future. Your actual cash flows will likely be different than the projection. Not planning puts you at much more risk than using your best guess.

Additional Scenarios Provide More Insights

Congratulations! If you followed all these steps you now have a very powerful cash flow projection for your business. The insights you gained from this projection will help you avoid the stress caused by a lack of cash.

Even more exciting, you may have excess cash that you can use to grow your business or distribute to yourself.

Now that you have a baseline projection you can learn so much more by exploring other scenarios. For example:

- Do you have enough cash to hire staff or buy equipment sooner than you projected in your baseline? Run a scenario to see how much sales and cash flow would increase by investing in staff or equipment sooner.

- What if there was an event that caused cash collections from sales to fall below your projection? Do you have enough cash cushion to weather it? Run a scenario with your best guess of the potential drop in cash. If you don’t have enough cash on hand you can adjust other cash flows to plan how you would deal with this situation.

You can save your baseline as a document and then create each of these scenarios and save them with other names. The power of the cash flow projection is in the thought you put into it to contemplate threats and capture opportunities. A cash flow projection is much more effective at this type of planning than budgets or income statement projections.

Failing to Plan is Planning to Fail

A classic adage states “failing to plan is planning to fail.” A U.S. Bank study found that 82% of small businesses fail due to poor cash flow management. You don’t have to be one of these. Taking the time to prepare a cash flow projection can help avoid the stress of tight cash flow and allow you to take advantage of opportunities. It can’t solve all your problems but it allows you to better prepare for them.

To get a cash flow projection template and helpful cash management ideas, check out my Managing Cash Flow course.

For more info, check out these topics pages: