Managing Cash Flow

Improving your business’s cash flow can reduce your stress and allow you to capture more opportunities.

Learn business cash flow best practices.

- OR -

MOST POPULAR

Get this course and all other CFO Perspective courses along with downloadable tools and access to Rob for only $290/year as part of a FAST membership.

FAST Member? Click here for instant access.

Here's What People are Saying About the Cash Flow Course

"Absolutely fantastic course! Makes me want to delve into this more. Thank you!!!"

"Outstanding course and a terrific instructor. He went through all of what you need to focus on to manage cash in your business."

"I was very impressed with this course... Highly recommend!"

"Great course offering perspective on the lifeblood of a business--cash. Thanks!"

"Great course and to the point. Lesson plan and slides were well put together and very informative. I would recommend this course to others."

"Rob does a great job discussing practical steps to take for increasing cash flow."

Are you a CPA? Get CPE Credit for this course.

Let Me Be Your Guide

I’m Rob Stephens, Founder of CFO Perspective. I’ve been the CFO of multiple companies. Early in my career, I worked for a company that went bankrupt from lack of cash. Later, I was the CFO of two banks that survived the Great Recession. I sat on loan committees where I saw borrowers make huge cash flow mistakes with their company. I’ve seen the good, the bad, and the ugly of cash flow management. I want to show you how to capture the good and avoid the ugly.

What You'll Receive

This course has over two hours of video to walk you through ideas that might improve your cash flow. You’ll also receive the following tools:

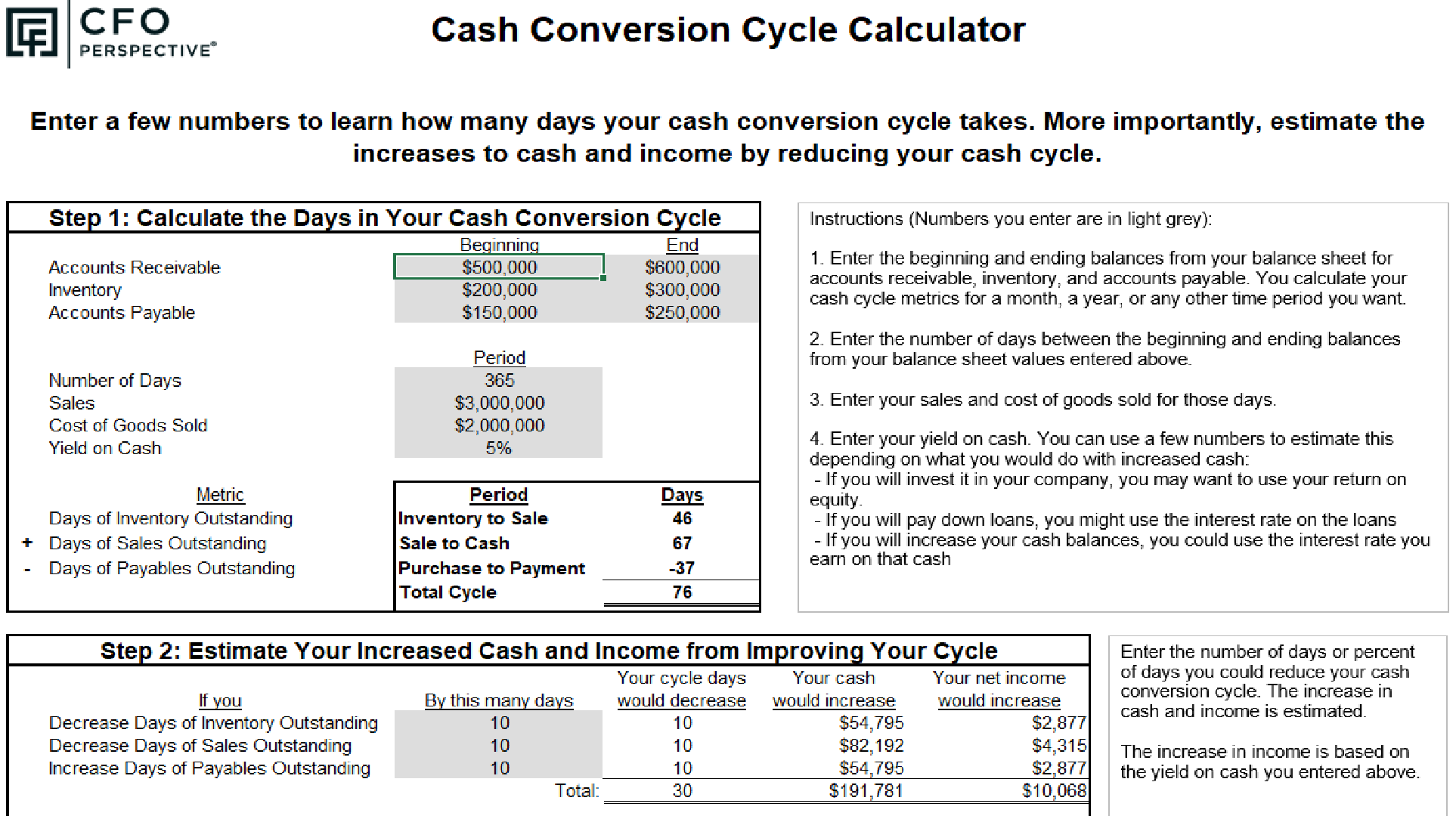

A cash conversion cycle calculator to calculate your current cash cycle. It will show you how much cash and profits could go up if you decreased the cycle time.

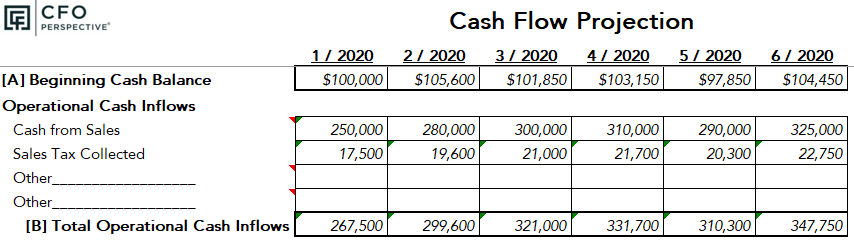

A 12-Month Excel cash flow projection template with step-by-step video instructions on how to fill it out.

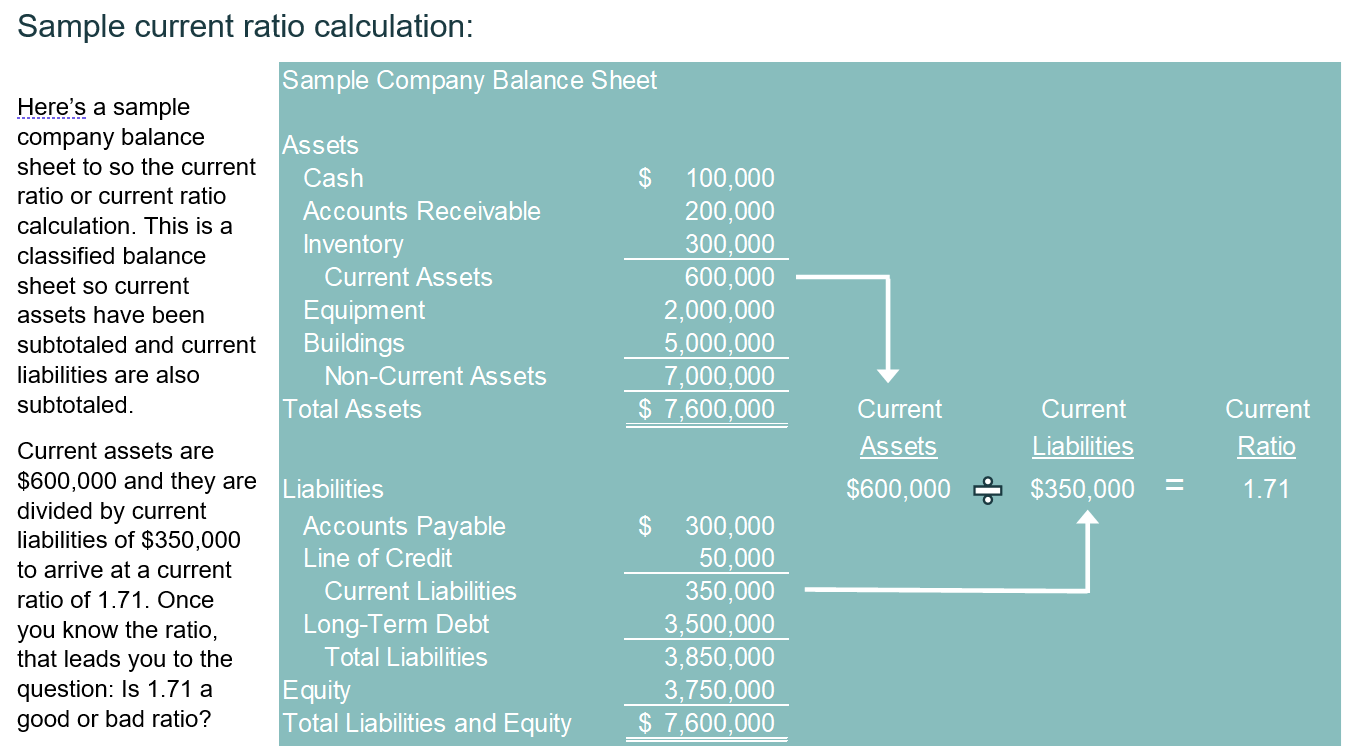

A guide on cash flow metrics you can monitor to better understand your cash flow.

How to speed up cash inflows and slow down cash outflows

The key cash flow metrics to monitor to keep a pulse on your company’s cash

How to calculate your sustainable growth rate and how to increase it.

More Kind Reviews

"Great course. Highly relevant and useful tools for future reference."

"Great course to go over how to manage cash flow and important aspects to consider for any level."

"Great course on cash flow management. Would recommend"

Stop making cash flow mistakes.

Learn cash flow management techniques that can improve cash flow.

- OR -

MOST POPULAR

Get this course and all other CFO Perspective courses along with downloadable tools and access to Rob for only $290/year as part of a FAST membership.

The Cash Flow course is one of the courses you get with a FAST membership.

FAST (Finance and Strategy Toolkit) is a membership program that gives you resources for better strategic financial management. You get all the CFO Perspective courses. Get direct access to me as well as tools for improved decisions that can lead to superior business performance.

The right tools can save you time, reduce your stress, and improve your effectiveness.

FAST Member? Click here for instant access.